The NFP report missed expectations and we think the bar for a hike on September 21st was much higher than economists’ predictions anyway. Nevertheless, here are two opinions that still see a rate hike coming while another one circles December.

Here is their view, courtesy of eFXnews:

August NFP: Labor Markets Squeak Past Threshold For September Hike – Barclays

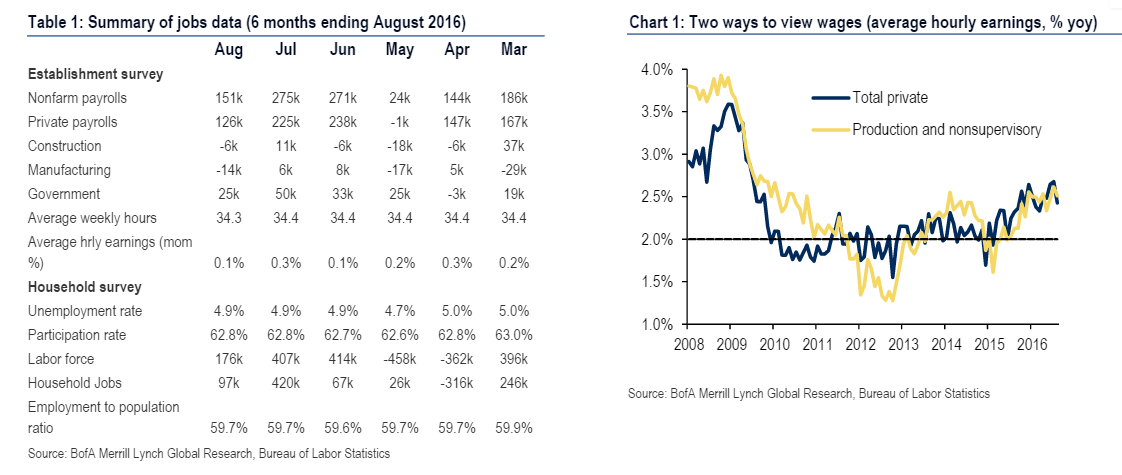

Nonfarm payroll growth came in at a solid 151k in August, below our forecast (200k) and that of consensus expectations (180k). The establishment survey softened a bit across the board, but continues to show solid underlying strength. The three month average gain in payrolls is now 232k. Goods sector employment fell 24k, consistent with softening in some survey indicators in recent data. Service sector employers added 150k; these private sector gains were further boosted by 25k in government job gains. The household survey shows an unemployment rate unchanged at 4.9%, as robust household employment was offset by a further rise in labor force participation. Finally, wage growth (0.1% m/m, 2.4% y/y) also softened a touch from last month.

On the whole, this morning’s strong July employment report, despite the slower pace of job gains, indicates that labor market health remains intact and that therefore economic activity remains solid. Furthermore, this print should maintain the confidence of most FOMC members in the outlook. Most members will view this report as consistent with solid economic activity and will believe that that activity will continue to pull inflation upward toward their target.

We maintain our call of a September rate hike.

August NFP: ‘Good Enough’ For A September Hike – BNPP

In August, 151,000 jobs were added, below consensus expectations for 180,000. The three-month average gain (232,000) far exceeds the range of estimates the FOMC sees as sufficient to keep the unemployment rate stable.

There is nothing in this report that flashes a warning signal about where the economy is going; very different from the May report that caused a scare. We see this as a solid employment report that is good enough for the FOMC to deliver a rate hike in September.

For the month of August, hiring in the goods sector was weak while the services sector normalized a bit after an outsized gain in July.

The tendency for August payrolls to disappoint is no secret. Downside surprises are usually followed by large upward revisions in the Bureau of Labor Statistics’ (BLS) second and third estimates (an average revision of 62,000 in the past five years).

August NFP: Feeling Weak: Keeping Our Fed Call For December Hike – BofA Merrill

The August employment report was weak, leaving us feeling comfortable with our call for the Fed to stay on hold in September and hike again in December.

Nonfarm payrolls expanded by 151,000. July was revised up to 275,000 from 255,000 but June was revised lower to 271,000 from 292,000, leaving net revisions at only -1,000. Average hourly earnings only rose by 0.1% mom, causing the year-on-year rate to slow to 2.4% from 2.7%. Weekly hours also contracted to 34.3, down from 34.4 in the prior month (revised from 34.5 initially). The unemployment rate remained unchanged at 4.9%, as did the participation rate at 62.8% and the underemployment rate at 9.7%.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.