The Australian dollar is at crossroads against the US dollar and also against the New Zeland dollar. Here are two opinions about the next moves:

Here is their view, courtesy of eFXnews:

AUD/NZD: S/T Sidelined, M/T Bullish – ANZ

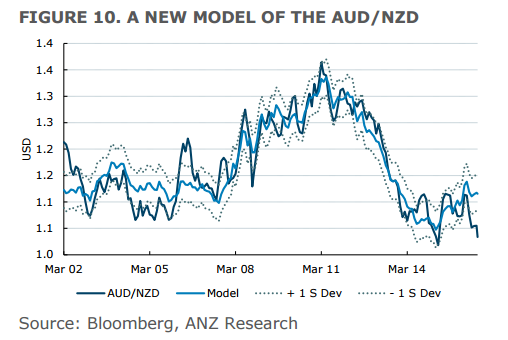

The AUD/NZD is once again approaching range extremes while at the same time increasingly diverging from historical drivers. This bifurcation alone cannot provide a catalyst for the cross, as it has persisted for some time now. As such, we took a clean slate approach to the cross and went in search of new drivers which either reconfirmed our previous biases or provided sufficient evidence for us to make a more wholesale change in our view.

The analysis that we have undertaken (both old and new) continues to strongly suggest further downside in the cross is not fundamentally justified. However, by that same token, there are a number of factors which explain why the NZD is more in favour at the moment. These factors look to be very well priced into the current level of the cross, and at the margin look to be at risk of eroding (the Australian mining sector is basing and global liquidity is peaking).

As such, we think we are at levels that present value, and continue to recommend that corporates or investors with a medium-term horizon begin to accumulate AUD. However, on a tactical basis (short-term) we are not ready to become out-right bullish on a spot basis. Sentiment looks to be one of the primary drivers of the cross and while that is the case, overshoots are still possible.

AUD/USD: Multiple Rejections Of L/T Downtrend Resistance; Negative M/T Momentum Shift – NAB

Trend:

Price has been captured in a parallel uptrend channel since bottoming in January 2016. Price has tested LT trend resistance (now at 0.7690/0.7710) in three of the past five weeks, each time failing to overcome this significant resistance level. The impulsive reversals that have accompanied each of these key resistance challenges imply that 0.7690/0.7710 remains a level that will be extremely difficult to overcome. Last week’s rejection places price back within a well-defined range with trend channel support at 0.7380/00 and 0.7690/0.7710 as its boundaries. The repeated rejections of the top of this range imply that the downside is likely to be tested in the weeks ahead. If support at 0.7380/00 were to break we would have confirmation that the multi-year downtrend was back in play.

Momentum:

LT momentum continues to confirm an uptrend bias. MT momentum on the flipside has shifted to a comprehensive negative bias following last week’s impulsive negative reversal in price. This implies further downside pressure on price in the weeks ahead.

Outlook:

A battle between the multi-year downtrend and the one year uptrend remains in play. Last week’s rejection of LT trend resistance, now at 0.7690/0.7710, keeps the LT downtrend in play. Negative MT momentum triggers now shift risk towards a test of the interim uptrend channel base at 0.7380/00. Only a weekly close below 0.7380/00 would confirm a significant bearish MT bias.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.