The Canadian dollar had its time in the sun, rising against the greenback when oil prices were advancing. The tables have turned, and the loonie could further fall.

Here is their view, courtesy of eFXnews:

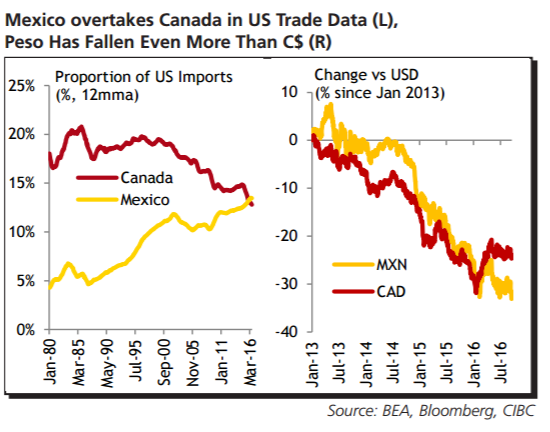

The value of trade between the US and China overtook that between the US and Canada as the world’s largest last year. And when it comes to goods exports to the US, Canada appears to be falling further down the list. Low oil prices have uncovered a weaker underlying trade performance, seeing Canada’s share of US imports fall. At the same time, Mexico has continued to pick up share. And a weaker loonie hasn’t made competing against a low-cost country such as Mexico any easier. Recent softness in the peso means that the Mexican currency has now fallen further against the US$ than the loonie has.

A continued uninspiring trade performance will weigh on the C$ against its American counterpart, seeing USDCAD rise to 1.37 by end-2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.