The Fed is not expected to raise rates in its highly anticipated September decision. However, there is no full agreement: 2 primary dealers, Barclays and BNP Paribas, see a rate hike coming. Also bond markets are not totally excluding this option and price it around 20%.

If Fed Chair Janet Yellen and her colleagues surprise with a hike, the US dollar will leap. It will be a huge shock if it happens, especially given the upcoming elections and the natural dovishness of the FOMC.

So, in this case, the world’s most popular currency pair, EUR/USD will crash. What levels should we look out for?

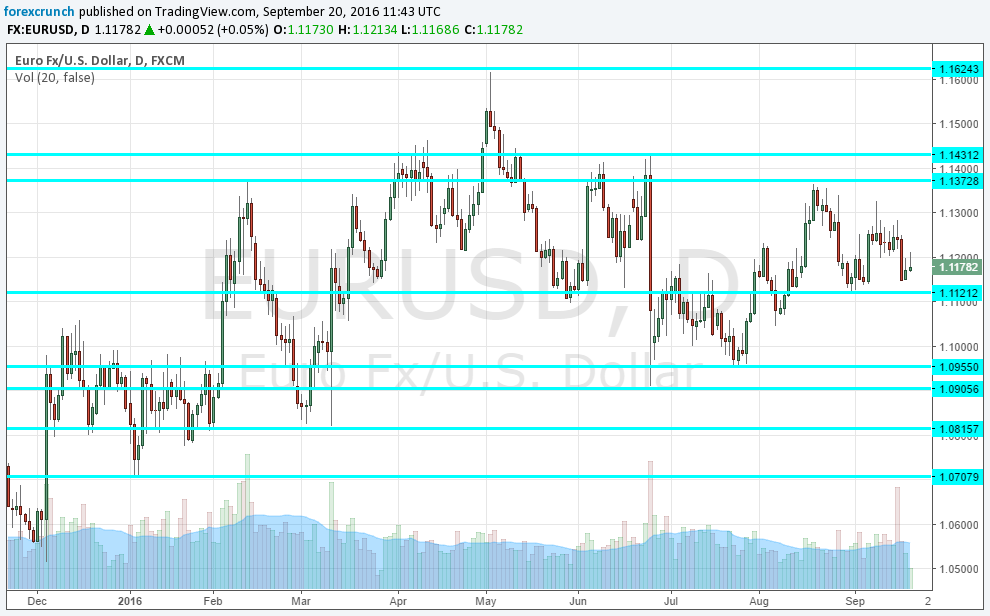

The pair is currently trading in the well-known range. Support awaits at 1.1120, a line visited around the end of August and thrived to recently. Further support awaits at 1.0960, a level seen in late July. The post-Brexit low of 1.0910 follows.

Further support to cushion the fall is only at 1.0820, the line the pair touched when markets were discontent with Draghi in March. Further strong support awaits at 1.0710 seen early in the year. Below, we are back to levels last seen in yesteryear: 10520 and 1.0460.

On the topside, we find 1.1370, the high line in August, followed by 1.1420, the pre-Brexit level and 1.1616, the peak for this year so far.

More: Is EUR/USD the new USD/JPY?