It seems like the Bank of England has a rather high bar on what it perceives to be good data. While the recent string of positive economic releases from the UK saw many institutional banks upgrade their forecasts on the UK’s economy, which only until a few months ago was tipped to slide into recession, the central bank had a different view, erring on the side of caution.

At the monetary policy meeting last week, the Bank of England left the key interest rate unchanged at 0.50%, while maintaining the asset purchase program at 435 billion GBP, by a unanimous vote. The previous dissenter, Ian McCafferty was also on board, this time, around.

The central bank’s meeting minutes, however, gave the view that policy makers are not taking things lightly. The meeting minutes had many references to potential policy easing in November. However, the bank’s statement showed that recent economic performance was better than expected.

“Nevertheless, since the August Inflation Report, a number of indicators of near-term economic activity have been somewhat stronger than expected. The Committee now expect less of a slowing in UK GDP growth in the second half of 2016,” the statement said.

UK inflation steady in August, but prices could rise

On inflation expectations, the central projects that consumer prices could rise to around the 2% target rate in the first half of 2017.

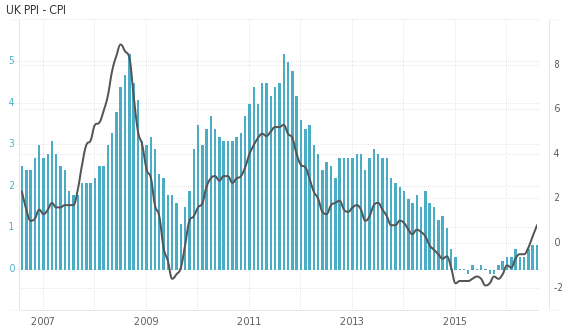

Recent inflation data showed that consumer prices were steady at 0.60% as transport costs offset the decline in restaurant and hotel prices. Headline inflation was weaker than market consensus which expected to see a print of 0.70%. However, producer prices were starkly in contrast. The cost of fuel and materials for companies rose 7.60% in August compared to a year ago, which as the ONS put it, “fastest rate of growth since December 2011.” The increase in prices came as a result of a weaker British pound which fuelled a 9.30% annual increase in import prices.

UK Producer Price Index (Black line) vs. Consumer Price Index (Blue Columns)

UK Producer Price Index (Black line) vs. Consumer Price Index (Blue Columns)

Labor markets showing signs of cooling

Last week also saw the release of the monthly jobs report. The data showed that hiring continued at a steady pace with the unemployment rate unchanged at 4.90%. But, wage growth was seen to have pulled back. Between May to July 2016, total pay increased 2.30% compared to the same period a year ago. This was lower than the previous period’s earnings of 2.50%. On the bright side, however, the number of people in work rose to a record high of 31.8 million, according to the ONS.

However, on closer observation, the wage growth period is seen as a period before the UK’s referendum vote. ING economist, James Knightely says, “We expect to see softer jobs growth in coming months while wage growth is unlikely to accelerate, with businesses set to act cautiously on pay given the economic uncertainty.”

The real test as far as wages and the labor market is concerned could likely come in a month’s time as the earnings period covers June and the following months.

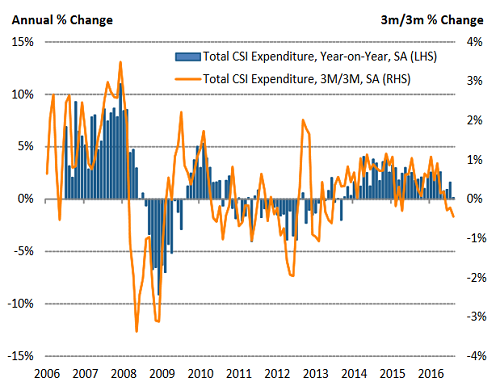

Retail sales could start slowing

While the initial retail sales report in June/July painted a rosy picture, the retail sales report for August was somewhat sobering. In August 2016, retail sales in terms of volume rose 6.20%, while on a month over month basis, retail sales decreased by 0.20% compared to July. The biggest drag on retail sales was from non-food stores. ONS said that “the underlying pattern in the retail sector was one of growth with the 3 months on 3 month movement in the quantity bought increased by 1.60%.”

Despite the optimistic report, questions still linger. Last Sunday, Visa released a report where it said that household spending saw the slowest growth in almost three months. Spending in August, according to Visa saw the smallest increase of only 0.10% on the year after rising 1.60% in July. While the report merely captures a small segment, the results are nonetheless worth paying attention to.

Visa, UK Consumer Spending Index, Aug’16: +0.10% (Source: visa.co.uk)

Visa, UK Consumer Spending Index, Aug’16: +0.10% (Source: visa.co.uk)

BoE sets the date for November

The Bank of England concluded its monetary policy report by stating that “The Committee will assess that news, along with other forthcoming indicators, during its November forecast round. If, in light of that full updated assessment, the outlook at that time is judged to be broadly consistent with the August Inflation Report projections, a majority of members expect to support a further cut in Bank Rate to its effective lower bound at one of the MPC’s forthcoming meetings during the course of this year. “

While November is still a long way out, the upcoming economic releases will no doubt gain more than the usual attention. In particular, the PMI surveys from Markit/HIS, inflation, wages and consumer spending will be the key in shaping investor expectations on the next policy move from the Bank of England. This week, Morgan Stanley was one of the first to come out bearish, stating in a research note that “the next GBP downward leg will soon unfold.” MS also notes that the slowdown in the economy could come from the supply side and notes that it could take months if not quarters in the slowdown in investment.

For the moment, it is anyone’s guess as to how the economic performance of the UK will unfold, but pay attention as future economic releases will be linked to policy response from the Bank of England.