GBP/USD has been struggling with 1.30, as talk of a “Hard Brexit” talk prevails. What’s next? The next few days could see downside pressure:

Here is their view, courtesy of eFXnews:

There is no doubt that uncertainty has increased and we’d agree that business investment is likely to be a major drag on UK economic growth. As Prime Minister Theresa May noted at the G20 meeting, “I’m not going to pretend that it’s all going to be plain sailing. I think we must be prepared for the fact that there may be some difficult times ahead”. The ‘difficult times’ theme was repeated by her Chancellor Philip Hammond and though he sounded confident about adjusting to a new relationship with the EU and the advantages it offers, businesses are understandably impatient for him to put some flesh on the rhetorical bones. ‘

German Chancellor Angela Merkel warned at the end of June that, “We will make sure that negotiations will not be carried out as a cherry-picking exercise. There must be and there will be a palpable difference between those countries who want to be members of the European family and those who don’t”, whilst her Italian counterpart Matteo Renzi insists, “The UK can enjoy access to the single market only if it accepts the four basic European freedoms – those of people, goods, services and capital”.

There will certainly be more political pressure on the UK Government – at home and abroad – to spell out in more detail its Brexit negotiating position. As Treasury Select Committee Chairman Andrew Tyrie eloquently argues, “the Government must be frank, both about the trade-offs involved, and the fact that many of the promises made by the ‘leave’ side are manifestly unfulfillable”.

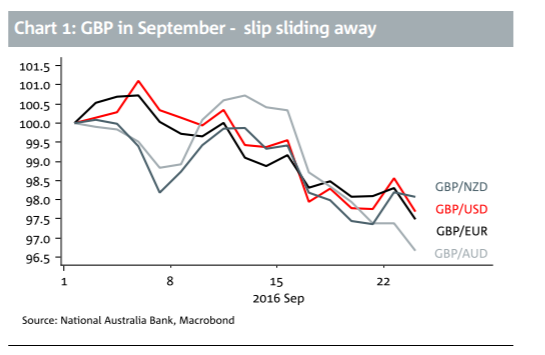

Net short GBP positions have now been scaled back from record levels, and there is certainly a risk as quarter-end approaches that some profit-taking pushes GBP/USD further away from the lower end of its post-referendum trading range.

Looking ahead, however, we retain our overall negative stance on the British Pound. Fears of an immediate recession have largely evaporated, but there’s little doubt that tough times lie ahead.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.