After the historic agreement to curb oil production has been announced, oil prices advanced. However, the skeptics are coming out quite quickly. Here is the opinion from Danske:

Here is their view, courtesy of eFXnews:

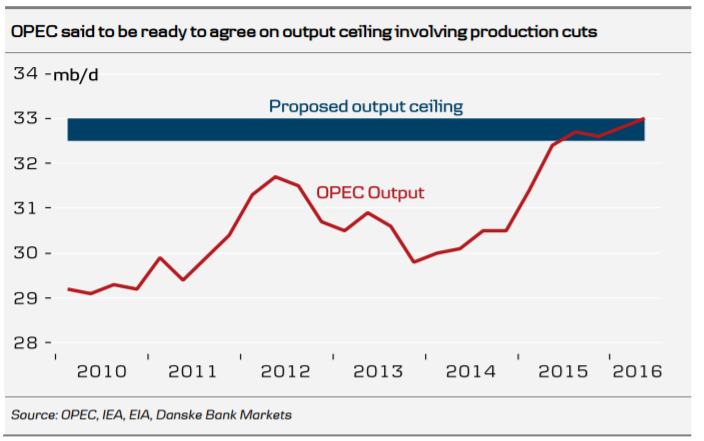

Following three days of negotiations in Algiers, OPEC may have reached agreement over a strategy to support a stabilisation of the oil market. At the time of writing, there has been no official statement from OPEC, but apparently OPEC has agreed to cut production to around 32.5-33mbpd from the level of 33.2mbpd in August, with the details of the agreement set to be finalised at the 30 November official OPEC meeting. Furthermore, meetings with oil producers outside OPEC are said to be carried out during October.

On the surface, it may look like a pivotal moment for the oil market, but an output ceiling below the current level of production is likely to prove difficult to implement in practice.

First, Libya and Nigeria are currently producing around 0.5-1mbpd below their full capacity due to internal rebels disrupting production. Hence, an output ceiling will have to make room for a potential recovery of their output. Second, most OPEC members are staring at large public budget deficits this year due to falling revenue from oil exports. That will test the credibility of an output ceiling as each individual member will have a strong incentive to cheat on such a deal. If OPEC in turn succeeds in implementing an output ceiling it will support oil prices, but in our view it will not trigger a prolonged oil market rally. Firstly, because it would be a small cut and because the main problem for the oil market in the first place is not too much supply but rather too weak demand due to a strong dollar, declining economic activity in, e.g. China and a halt in growth in global goods trade.

Second, OPEC risks handing over market shares back to, e.g. US shale oil producers who have cut production in response to the fall in oil prices. In the near-term, the oil market will monitor hints over the details of the apparent deal put forth in Algiers.

The immediate market reaction was positive, pushing oil prices up USD2/bl above USD48/bl. However, this move may quickly reverse if the market starts to cast doubt over whether the deal will be carried out. Hence, this will add to the already volatile oil market in the coming months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.