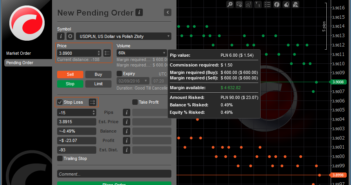

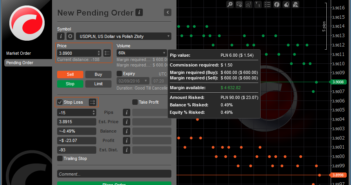

Spotware Systems has been working on new features for cTraders. Here are more details from the official press release: Limassol, Cyprus – September 2, 2016 Spotware Systems announce the latest features included in the just released September 2016 update of cTrader for Windows as the company continues to deliver regular product updates to benefit traders. … “cTrader for Windows gets new features”

Month: September 2016

cTrader for Windows gets new features

Spotware Systems has been working on new features for cTraders. Here are more details from the official press release: Limassol, Cyprus – September 2, 2016 Spotware Systems announce the latest features included in the just released September 2016 update of cTrader for Windows as the company continues to deliver regular product updates to benefit traders. … “cTrader for Windows gets new features”

US Dollar Ends Week Mixed as NFP Muddles Fed Outlook

The US dollar ended the trading week mixed as the outlook for Federal Reserve’s monetary policy was clouded by surprisingly weak employment growth. The US dollar has started the week on a strong footing as comments from Fed officials led market participants to believe that an interest rate hike, perhaps even two, is very likely this year. Yet the disappointing employment report made them change their view. It is … “US Dollar Ends Week Mixed as NFP Muddles Fed Outlook”

Canadian Dollar Finds Support in Domestic Data & Rally of Crude Oil

The Canadian dollar jumped against its counterparts during Friday’s trading, supported by the rally of crude oil prices and Canada’s positive macroeconomic data. Disappointing US employment data had a big impact on the market. It not only helped the Canadian currency directly, allowing the loonie to outperform the greenback, but also provided indirect support by boosting prices for crude oil. The Canadian dollar also get support from Canada’s economic indicators. … “Canadian Dollar Finds Support in Domestic Data & Rally of Crude Oil”

Is the NFP still good enough for a September hike?

The NFP report missed expectations and we think the bar for a hike on September 21st was much higher than economists’ predictions anyway. Nevertheless, here are two opinions that still see a rate hike coming while another one circles December. Here is their view, courtesy of eFXnews: August NFP: Labor Markets Squeak Past Threshold For September Hike … “Is the NFP still good enough for a September hike?”

Dollar Bounces After Dropping on NFP

The US dollar recovered from earlier losses that followed disappointing non-farm payrolls. The bounce was a result of persisting speculations about the possibility of an interest rate hike this year. For whole week, traders were waiting for US employment data, thinking that NFP would support the case of monetary tightening. Yet the actual report proved to be disappointing as all important parts missed expectations. Unsurprisingly, that hurt the dollar. What … “Dollar Bounces After Dropping on NFP”

Yen Goes Down, Economic Data Doesn’t Support

The Japanese yen weakened a bit today even though economic data released from Japan was relatively good and should have supported the currency. The seasonally adjusted Consumer Confidence Index was up from 41.3 to 42.0 in August, exceeding the predicted figure of 41.6. Monetary base decreased from 24.7% to 24.2% last month, yet it was above the analysts’ expectations of 23.1%. Despite all of that, the yen fell as traders’ … “Yen Goes Down, Economic Data Doesn’t Support”

Pound Little Changed After UK Construction PMI Improves

Today, yet another macroeconomic indicator added to evidences of an improving economy in the United Kingdom. Unlike yesterday though, the Great Britain pound demonstrated anemic reaction to positive news. The seasonally adjusted Markit/CIPS UK Construction Purchasing Managersâ Index climbed to 49.2 in August from the multi-year low of 45.9 posted in July, though remained in the contraction territory. Yet the sterling’s reaction to the report was muted, unlike yesterday when the currency rallied on the manufacturing … “Pound Little Changed After UK Construction PMI Improves”

EUR/USD: Trading the US Non-Farm Payrolls

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. NFP only 151K, … “EUR/USD: Trading the US Non-Farm Payrolls”

UK Pound Climbs with Help from Manufacturing

The Great Britain pound rallied today, boosted by the surprisingly strong manufacturing sector, reaching the highest level in about a month against some of its major rivals. The seasonally adjusted Markit/CIPS Purchasing Managersâ Index jumped from the 41-month low of 48.3 logged in July to 53.3 in August. The actual reading was far above 49.1 estimated by specialists ahead of the report. The data added to the slew of robust economic indicators that suggested limited impact … “UK Pound Climbs with Help from Manufacturing”