The US dollar was soft today due to uncertainty associated with the US elections and presidential debates ahead of them. The greenback managed to stay flat against the Great Britain pound and the Swiss franc. Furthermore, the US currency advanced versus the Canadian dollar. The first of the four planned presidential debates between Hilary Clinton and Donald Trump is going to happen today. Market participants are worried about the possibility of Trump gaining more … “US Dollar Soft as Traders Worry About Presidential Elections”

Month: September 2016

Debate preview: 3 reasons why Clinton could win and

The US elections are set to get much more attention, for voters and markets. The first presidential debate between Hillary Clinton and Donald Trump will be held on Monday, September 26th at 9 PM Eastern, that’s 1:00 GMT. While the event happens during the Asian session, it could have ramifications for the next few sessions, especially … “Debate preview: 3 reasons why Clinton could win and”

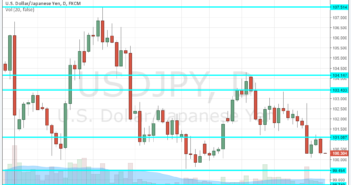

3 reasons to watch USD/JPY for a real debate reaction

The US presidential campaigns are moving one step up with the first debate between Hillary Clinton and Donald Trump. With the race tightening towards Trump, there is a lot at stake. Clinton represents continuation vs. the Donald Disruption: a gray, mainstream candidate that will continue the current path while the challenger is disruption, and we do not … “3 reasons to watch USD/JPY for a real debate reaction”

USD and the first Presidential Debate – Barclays

The first US presidential debate is coming up. We noted why 3 reasons why Clinton could win and markets will like it, but anything is possible. Here is the view from Barclays: Here is their view, courtesy of eFXnews: The USD will likely trade sideways after losing some ground since the FOMC decision last week. Despite not hiking interest rates in … “USD and the first Presidential Debate – Barclays”

Pound Goes Lower as Brexit Fears Return

The Great Britain pound was soft against some of the majors (though stayed flat versus the US dollar) as Brexit fears were returning to the market. News that the United Kingdom may start the process of leaving the European Union early caught many market participants off guard, triggering panic selling of the sterling. Now, analysts are talking about the so-called hard Brexit with the UK losing access to the EU single market. … “Pound Goes Lower as Brexit Fears Return”

Japanese Yen Higher Even as Kuroda Speaks About Easing

The Japanese yen appreciated against other most-liquid currencies today after the speech of Haruhiko Kuroda, Bank of Japan Governor, even though he was talking about a possibility of additional monetary easing. Kuroda reiterated that he is ready to ease monetary policy further if necessary, saying: There can be cases where such powerful monetary easing is needed, depending on developments in economic activity and prices as well … “Japanese Yen Higher Even as Kuroda Speaks About Easing”

Future Does Not Look Bright for Canadian Dollar

There are plenty of factors that could impact the performance of the Canadian dollar this trading week. Unfortunately for the currency, most of them are negative. Letâs look at the most important of them. We will start with events in Canada itself. Stephen Poloz, Bank of Canada Governor, will speak at Western Washington University on Tuesday overnight. If his speech is relatively hawkish, then the currency will likely rise. Canadaâs … “Future Does Not Look Bright for Canadian Dollar”

Why the Algiers gathering will NOT help oil prices

Once again, OPEC members are discussing a potential deal to lift oil prices. A total cut seems to be off the cards, but some freeze in production levels could be possible in the gathering on the sidelines of a conference in Algiers. Given the past, there are many reasons to doubt this. Here is what’s going on. Algiers … “Why the Algiers gathering will NOT help oil prices”

3 Reasons Why JPY Will Weaken M-Term On BoJ New

The Bank of Japan did not make huge changes in the short run, but made long-term changes. Will markets acknowledge it in the medium-term? Here are three reasons, according to Nomura: Here is their view, courtesy of eFXnews: The BOJ’s new policy framework aims to improve the sustainability of its easing, as the Bank acknowledges the … “3 Reasons Why JPY Will Weaken M-Term On BoJ New”

USD/JPY: Trading the US CB Consumer Confidence Index

US CB Consumer Confidence Index is based on a monthly survey of about 5,000 households regarding their opinion of the economy. Its release often has a strong impact on market prices. A higher reading than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Published on … “USD/JPY: Trading the US CB Consumer Confidence Index”