The Australian dollar rose against the US dollar and the euro today after the release of yet another positive leading index from Australia. The Westpac-Melbourne Institute Leading Index showed an improvement in August. The report said: The Leading Index is clearly signalling that the economy is likely to continuing growing around its long run trend rate of about 3% a year. Earlier this week, Conference Board released its leading … “Australian Dollar Rises After Release of Leading Index”

Month: September 2016

Yen Trades Higher After BoJ Meeting

The Japanese yen climbed against its major rivals today after the Bank of Japan concluded its monetary policy meeting, adjusting the policy but refraining from a major stimulus expansion. The BoJ kept its main interest rate at -0.1% and tweaked the asset purchase program, focusing on yield curve. But investors felt that the move was underwhelming without a significant addition of monetary accommodation. Such view helped the yen to maintain … “Yen Trades Higher After BoJ Meeting”

FOMC Preview: Dollar Depends on Door to December

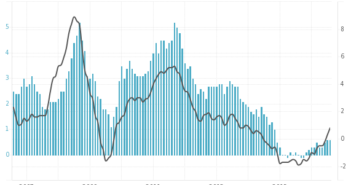

The bigger the crack, the stronger the dollar. Oh, a rate hike now in September? The chances are extremely small. Nevertheless, the lack of a rate hike does not mean markets will not move. It’s a big event. This Fed decision is accompanied by updated forecasts as well as a press conference by Yellen. The hype means … “FOMC Preview: Dollar Depends on Door to December”

Swiss Franc Trades Higher on Tuesday

The Swiss franc traded higher against its most-traded rivals during Tuesday’s trading ahead of Wednesday’s monetary policy announcement from the Federal Reserve. The Swiss trade balance logged a surplus of CHF 3.02 billion in August, up from CHF 2.86 billion in July, though it was still smaller than the consensus forecast of CHF 3.27 billion. Meanwhile, the State Secretariat for Economic Affairs updated its forecast of Switzerland’s economic … “Swiss Franc Trades Higher on Tuesday”

Aussie Higher vs. Greenback & Euro After RBA Minutes

The Australian dollar was mildly higher against its US counterpart and the euro after the minutes released by the Reserve Bank of Australia showed that the central bank was not in a hurry to cut interest rates further. The RBA said in the minutes of the September meeting that “recent data suggested that growth had been around estimates of potential growth over the first half of 2016” and “interest-sensitive sectors of the economy were being supported by accommodative … “Aussie Higher vs. Greenback & Euro After RBA Minutes”

BOJ: Expect pressure on USD/JPY – Three opinions

If uncertainty about the Fed’s decision is significant, the clouds surrounding the BOJ are huge. As officials in Tokyo conclude their assessment of their QQE program, basically anything can happen. Nevertheless, here are opinions saying that pressure on USD/JPY will likely continue, regardless of the outcome: Here is their view, courtesy of eFXnews: Sep BoJ: … “BOJ: Expect pressure on USD/JPY – Three opinions”

And if the Fed raises rates? Levels to watch on EUR/USD

The Fed is not expected to raise rates in its highly anticipated September decision. However, there is no full agreement: 2 primary dealers, Barclays and BNP Paribas, see a rate hike coming. Also bond markets are not totally excluding this option and price it around 20%. If Fed Chair Janet Yellen and her colleagues surprise with a hike, … “And if the Fed raises rates? Levels to watch on EUR/USD”

Bank of England, not yet impressed with UK economic data

It seems like the Bank of England has a rather high bar on what it perceives to be good data. While the recent string of positive economic releases from the UK saw many institutional banks upgrade their forecasts on the UK’s economy, which only until a few months ago was tipped to slide into recession, … “Bank of England, not yet impressed with UK economic data”

Canada Settles Flat on Monday

The Canadian dollar was little changed during the Asian trading session after closing almost flat at the end of the Monday’s session. As usual, the currency was following moves of crude oil, which this time has not been able to help the loonie in determining its trend. Prices for crude was rising during Monday’s trading, helping commodity currencies, and the Canadian dollar in particular. Yet the upward momentum of oil prices had faded … “Canada Settles Flat on Monday”

Dollar Trades Little Lower on Monday

The US dollar traded with small losses on Monday ahead of the two-day policy meeting scheduled by the Federal Reserve this week. Speculations about possible actions of the US central bank remain an important factor for determining moves of the greenback. The vast majority of market participants are sure that the Fed will not announce a change to its monetary policy on Wednesday after ending the meeting. Yet while previously traders were not bothered … “Dollar Trades Little Lower on Monday”