The lack of volatility in EUR/USD of late does not necessarily mean it will stay so for too long. The team at Goldman Sachs describes a “dollar story” for the pair heading into year-end, and sets cascading targets going forward:

Here is their view, courtesy of eFXnews:

Motivation for Our FX View:

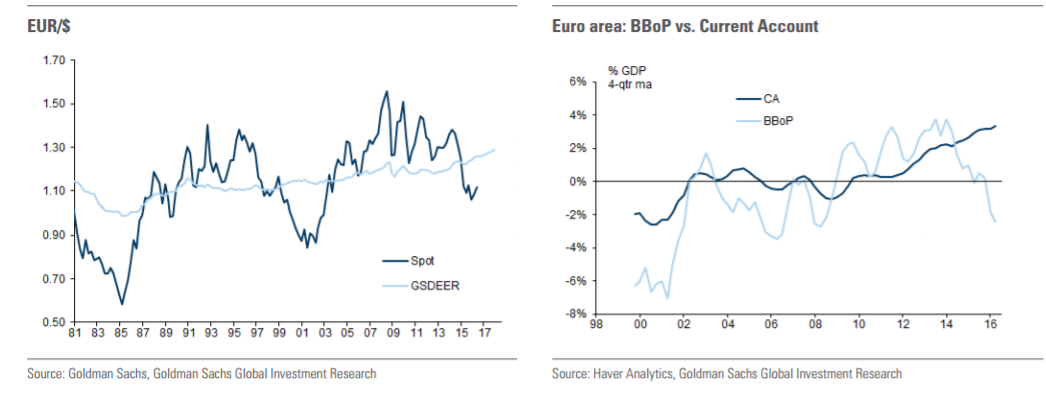

We continue to believe that EUR/USD will move lower on diverging growth, inflation and monetary policy outlooks. In the near term, we expect the ECB to announce an extension of the asset purchase programme at the current pace until the end of 2017, but no other additional measures. Thus, till year-end, EUR/$ is mainly a Dollar story.

Despite this and the recent strength, the EUR has weakened significantly over the past two years, and we think this EUR weakening trend has a long way to run.

We see a couple of longer-term fundamental forces at work. First, the flow picture should turn increasingly EUR-negative as Euro area residents send funds abroad and reserve managers allocate away from the EUR. Second, we think there is a structural element to disinflation in the periphery as it continues to improve competitiveness compared with the core of the Euro area.

As a result, our view is that inflation will be slower to pick up than during a normal cycle, in line with projections from our European team, which show HICP inflation still at 1.3% in 2018Q4. This should keep ECB policy accommodative, maintaining downward pressure on the EUR.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

EUR/USD Targets:

EUR/USD forecasts at 1.08, 1.04 and 1.00 in 3, 6 and 12 months.

Things to Watch:

Lack of implementation of fiscal and structural reforms remain a key risk. A shift towards more credit easing from the ECB could also be a headwind for our weaker EUR view.