Summary:

- US economy posts 72 consecutive months of positive jobs

- However, jobs slow for the third consecutive month

- July/August payrolls revised lower by 7k

- Fed’s Mester: 75k – 120k needed to keep unemployment stable (3-month average of +190k)

- Participation rate rises from 62.8% to 62.9%

- Wages up 2.60% from a year ago

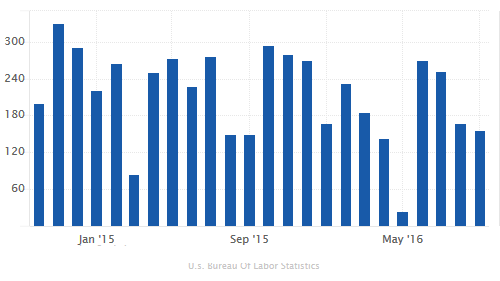

Following a steady trend into the second quarter of the year, the US nonfarm payrolls have turned consistently lower over the past three months. Despite the recent weaker pace of jobs, September’s payrolls marked a 72nd consecutive month of positive jobs growth.

Latest data released by the Bureau of Labor statistics showed on Friday that the US economy added 156k jobs during the month of September. Economists were expecting to see a print near the 170k region.

September Nonfarm Payrolls, 156k

September Nonfarm Payrolls, 156k

The unemployment rate ticked higher to 5.0%, ending a 3-month steady trend of 4.90% while wages rose 0.20%, less than the forecast of 0.30% but better than the 0.10% increase seen in August. On a year over year basis, average earnings rose 2.60%.

August and July payrolls were also revised. While August NFP was revised from 151k to 167k, July payrolls were revised lower from 275k to 252k.

The uptick in the unemployment rate was attributed to an increase in the participation rate, which rose from 62.80% to 62.90%.

The report also showed that jobs in the manufacturing sector which covers mining, oil and natural gas fell by 13k during the month.

Glass half full or half empty

The market reaction to the September payrolls report was mixed and it wasn’t surprising. For some analysts, the payrolls report suggested a disappointing trend especially in the aspect of wage growth. Mark Hamrick from Bankrate.com said, “We continue to wait for a more satisfying improvement in wage growth. Average hourly earnings rising 2.6% over the past year gets us back to where we were a few months ago.”

For others, the report was seen as a validation of Fed Chair, Janet Yellen’s concerns that there was still a lot of slack in the labor market.

Thomas Byrne of Wealth Strategies and Management said, “The U3 Unemployment Rate rising to 5.0% and Labor Force Participation rising to 62.9% points to significant labor market slack. Thus, we are probably farther away from full employment than many economists think.”

For the majority, however, September payrolls report which is the first out of three reports ahead of the December Fed meeting did not show anything new. As Brian Jacobsen, portfolio strategist at Wells Fargo put it, “Doves will be able to spin this to their liking and hawks will be able to spin it to theirs.”

FOMC meeting minutes on Wednesday

The Federal Reserve will be releasing the meeting minutes from the September policy meeting which saw interest rates being left unchanged at 0.50%. However, the markets will get a glimpse of the meeting which saw three voting members dissent, favoring a 25bps rate hike. The meeting minutes could no doubt be hawkish especially in light of the September payrolls which keeps the status quo unchanged. Even though the September jobs report failed to offer anything substantial, the bond market reaction was muted as yields quickly recovered following an initial dip in a knee jerk reaction to the report. By Friday’s close, the yield on the 10-year bonds settled at 1.723%

Yellen to speak on Friday

Fed chair Janet Yellen will be delivering her speech on Friday, October 14th at a Boston Fed conference. Her comments, especially reflecting on the September jobs report will be crucial for the markets which have been obsessed by the Fed rate hike, for the most part, this year.

So far, initial reaction to the jobs report included Cleveland Fed President, Loretta Mester a known hawk who called the jobs report ‘solid.’ Speaking to CNBC’s Squawk Box on Friday, Mester said “It’s a solid labor market report. This is very consistent with what we expected to see.” She said that 75k – 120k per month is the headline print required to keep unemployment stable and said that the three month average this year has been 192k.

This was later followed by Fed Vice Chairman, Stanley Fischer who said on Friday that the September jobs report was “pretty close” to the Goldilocks ideal noting that “unemployment was declining and wage growth is picking up towards 3%.”

The Fed speak next week is likely to see similar comments from other members, which could keep the US dollar supported alongside what could be a hawkish FOMC meeting minutes. With the exception of the immediate risk from the US presidential debate on Sunday night, the US dollar could be well on its way to maintaining its bullish momentum in the coming week.