EUR/USD has settled under 1.10 ahead of the all-important ECB meeting, in which no news could be bad news for the euro. Here is the view from Nomura, providing 5 scenarios:

Here is their view, courtesy of eFXnews:

Market expectations for an immediate policy change by the ECB are muted as we approach the meeting this week. Recent euro area economic data show the resilience of the economy, and a rate cut looks unlikely for now. Expectations of a rate cut into the meeting this week are fairly muted in the rates market.

The October meeting can be still important for the FX market, as markets are waiting for clarification on the future of the QE programme. We do not expect the ECB to make any final decisions on the QE programme this week, but any suggestions as to the likely path of the QE at the press conference could influence the euro area yield curve. FX market interest in the possibility of further bond sell-offs is rising, and the ECB’s policy stance can influence the broader FX market, not only EUR.

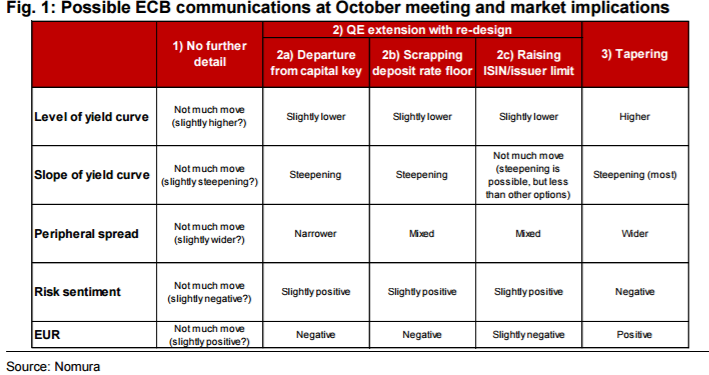

Five possibilities: This week the ECB may communicate: 1) no details as to the future path of QE, 2) indications about extending QE further, or 3) indications of approaching tapering.

Then, if the ECB is inclined to extend the QE further, we see three likely options for the Bank to enable the extension: 2a)departure from the capital key, 2b) removal of the deposit rate floor, and 2c) increase in ISIN/issuer limits.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Conclusion: We believe the ECB’s next step will be to extend its QE programme, not to taper it, and stronger indications of a QE extension would keep EUR/USD depreciating at its current pace.

Curve steepening is possible, but steepening owing to a QE extension would probably not cause a negative reaction in risk sentiment, which would enable USD/JPY to maintain its recent appreciation trend too. If ECB communication further increases market concerns about near-term tapering, the curve could steepen and risk sentiment deteriorate. This would challenge the recent trend of EUR/USD depreciation and USD/JPY appreciation. It is possible that the ECB does not offer any further details as to the future of QE, which would lead to muted reactions in the FX market. Under that scenario, comments by ECB officials and possible media leaks regarding the future of the QE programme, beyond the meeting next week, could increase EUR volatility into the December meeting.

As we expect the ECB to choose to extend the QE programme in the end, we judge EUR/USD downside risk is higher into the December ECB/Fed meetings.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.