After taking over the reins of the RBA from Glenn Stevens, the new RBA governor, Philip Lowe gave his first speech last week. Addressing the low-interest rates from the central bank, Lowe took a hawkish stand noting that “things are improving.”

Delivering his first speech on inflation and monetary policy, the new RBA governor reminded the markets that interest rates were already lower and there was no chance for further rate cuts. But he also acknowledged the fact that low inflation expectations remained entrenched.

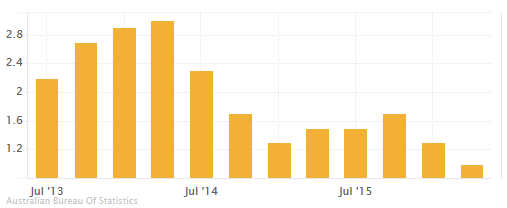

As with most other developed economies, Australia’s inflation has remained weak. In the second quarter, Australia’s headline inflation rose 0.40% as expected and managed to rebound from Q1’s 0.20% decline in inflation. The next inflation data should be published this week, on October 26, Wednesday.

Speaking on the reasons for low inflation, Lowe said that inflation across the OECD has been below the 20-year average and said that the weaker oil prices over the past two years had sent fuel prices in Australia falling by over 20%. “[It] has lowered the year ended rate of headline inflation by almost 0.4 percentage points over each of these years,” Lowe said.

In contrast, housing prices have increased, thus pushing inflation on average by 0.40%, the governor said.

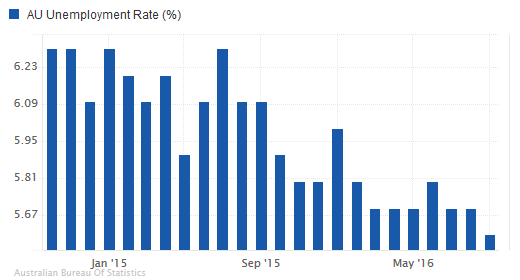

Australia jobless rate falls to 5.6%

Last week, data from the Australia Bureau of Statistics showed that the unemployment rate fell to 5.6% on a seasonally adjusted basis. It was below forecasts of 5.7% and lower from the previous month. The economy was seen losing 9800 jobs in September; missing estimates of a 15k increase in employment and marks the second month of job losses, from 8600 in August.

Australia Unemployment Rate: 5.6%, September 2016

Full-time employment fell by 53k while part-time work rose 43.2k during the month.

In his speech, the RBA governor said that “increased competition has forced existing retailers to find efficiencies to lower their costs.” According to Lowe, one factor was the rise in underemployment, and that people were working part-time jobs rather than full-time.

The RBA governor said that low prices from abroad had increased the competitiveness and thus an increase in spare capacity which is one of the contributing factors to inflation.

UBS chief economist Scott Haslem said on the jobs report that “jobs growth is now clearly slowing, with growth entirely driven by part-time over full-time.” Many experts are of the view that the RBA could be seen holding rates steady at next month’s meeting with no rate cut in sight, but next week’s inflation report could come at a risk.

RBA October meeting minutes

Earlier last week, the minutes from the October RBA meeting showed that policy makers judged that holding rates steady was consistent with inflation and growth targets. The members of the board noted that they would be assessing the third quarter inflation data ahead of the policy meeting to decide on the future course of interest rates. The minutes also showed that the central bank would consider housing, labor, and economic outlook and assess the impact of past rate cuts when it meets in November.

Reference to the AUD’s exchange rate was also made with policy makers noting that an appreciating currency could complicate economic rebalancing.

RBA seen holding rates steady in November

Considering the above and the speech from the RBA governor, it is unlikely to expect further rate cuts from the central bank. The next RBA policy meeting is scheduled for November 1st, and interest rates are very likely to remain steady at 1.50%.

Australia Inflation Rate: 1% (Q2, 2016)

Of course, this view could change if this week’s inflation report will disappoint. Analysts expect headline inflation in Australia to rise 0.5% in the quarter ending September. This is marginally higher than the 0.4% inflation increase in Q2. The trimmed mean CPI is forecast to rise 0.4%, slower than 0.5% increase registered in the second quarter. With fuel prices being the biggest contributing factor to inflation last quarter, the broad uptick in oil prices during the third quarter could potentially spell an upside surprise to the inflation rate in Australia.