While also the euro is suffering from the talk of “Hard Brexit”, the pound is the bigger loser for a nasty UK-EU breakup. And it is not the only reason for a EUR/GBP. Here is the opinion from SocGen:

Here is their view, courtesy of eFXnews:

How do we profit from a period of EUR/USD drifting lower in its current range as US Treasury yields edge higher, before possibly rising sharply at some point in the next six months, which is impossible to see with any precision?

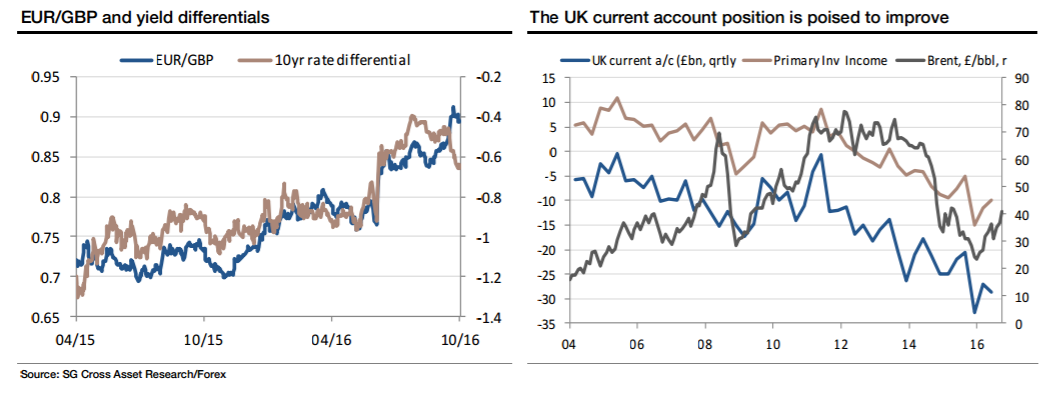

In spot, our preference is to take advantage of EUR/USD softness to buy EUR/GBP. The risk now is a broader loss of confidence in UK assets amidst political and economic uncertainty that would hurt UK bonds, currency and equities at the same time. That would send EUR/GBP up almost as much as GBP/USD fell.

Two big tail risks, for GBP down and EUR up, can make for a large move in EUR/GBP*. The danger is that now that we have seen the big adjustment in the pound, what we get from here is a tight range with low volatility, but for a directional trade, EUR/GBP looks to have a very big upward skew in the possible outcomes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

It’s only fair to point out that one threat to the UK that shouldn’t be overstated is the dire state of the balance of payments. Yes, the UK current account deficit is running at a quarterly rate of over £30bn, but it will soon improve. The vast bulk of the deterioration, shown in the chart below, comes from primary investment income, which mostly means the balance of income UK companies earn abroad relative to what foreign companies earn in the UK. A weak pound should help correct this, but so should higher oil and commodity prices. A strong pound and soft commodity prices really hit the overseas earnings of big UK-based resource companies, but the sterling price of oil is bouncing fast. This is worth watching, particularly when the 4Q and 1Q current account data are released next year.

SocGen maintains a long EUR/GBP* position from 0.8620 in its portfolio.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.