While EUR/USD continues recovering above 1.09, hopes are not so high. The team at Credit Suisse sees lower ground ahead:

Here is their view, courtesy of eFXnews:

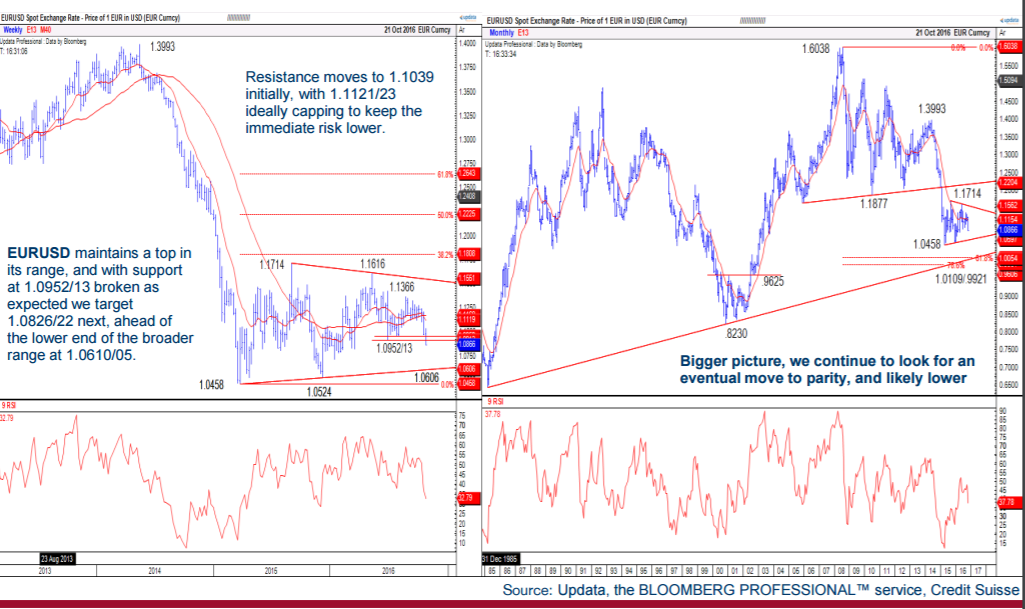

EURUSD paused to catch its breath holding near the recent lows. This leaves the trend still directly lower to test price support next at 1.0826/22 ahead of the January low at 1.0711.

We would expect to see a bounce here, but beneath it can expose the lower end of the medium-term range at 1.0610/05. We would look for a fresh floor to be found here.

Resistance moves to 1.0912/16 initially, then 1.0952/63, with 1.1002/39 ideally capping to keep the trend directly lower.

Bigger picture, we continue to look for an eventual move to parity, and likely lower.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Whilst we remain bearish EURUSD, it is worth noting though rises in EUR real rates can often be associated with a stronger EURUSD. If we do see 10yr EUR real rates establish a bearish reversal above 1.19%, there is a risk this may well dampen EURUSD weakness,arguing that support at 1.0610/05 should continue to hold for the time being.

CS maintains a short EUR/USD targeting a move to 1.0615.