The US elections are less than a week away, with worries of a Trump victory hurting the US dollar. The team at TD moves away from the greenback to the safe haven yen vs. commodity currencies:

Here is their view, courtesy of eFXnews:

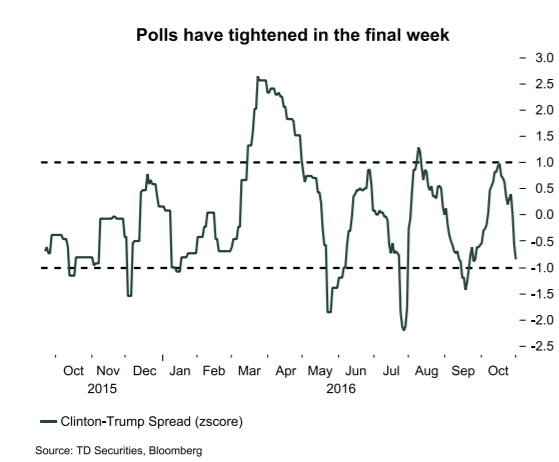

The US election has also captured market participants attention recently. The chart below shows the Clinton-Trump poll spread, standardized over the full time series. It indicates that the recent tightening of the polls has been about a one standard deviation move, which has added some risk premium back into markets.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

This risk premium has helped squeeze market positioning with traditional safe havens (EUR and JPY) firming and North American currencies (CAD and MXN) softer. The ADXY has also underperformed given exposure to global trade.

With the polls tightening, we still like longs in EUR and JPY. Short AUDJPY or CADJPY remain good proxy hedges, and we also like long EURNZD.