Election day is today and everything is ready. Here is our full guide, video guide, and all the updates. And here is the view from TD:

Here is their view, courtesy of eFXnews:

We provide a brief cheat sheet for the timeline and key issues to watch on election night, as well as our views on expected market reactions. Current polling would suggest a Clinton victory, the Republicans maintaining control of the House and the Senate returning to the Democrats by a slim margin.

Bottom Line: If current state-level polling is correct, Clinton would win 294 electoral votes, above the 270 needed to win.

Safe votes: Polling suggests 222 safe electoral votes for Clinton and 155 for Trump.

Likely Votes: There are then another 42 electoral votes from states (PA, WI, RI, ME, NH) that seem likely to vote for Clinton given her margin in the polls. For Trump, there are 25 electoral votes (GA, UT, AK) that are likely to vote in his favor unless there is a strong Clinton victory panning out through the night.

Leaning Votes: Given the tightening in the polls, the night will likely come down to the seven states that are leaning slightly in favor of each candidate. The above leaves Clinton at 264 votes, with 270 needed to win. Clinton would need to win one of the three states which are leaning marginally in her favor in the polls—North Carolina, Colorado, and Nevada. For Trump, there are four key races to watch to gauge his chances—Ohio, Florida, Arizona, and Iowa—here polls are leaning in his favor, but could be close. If he loses any of those, the odds of winning the Presidency are low.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Market Reaction:

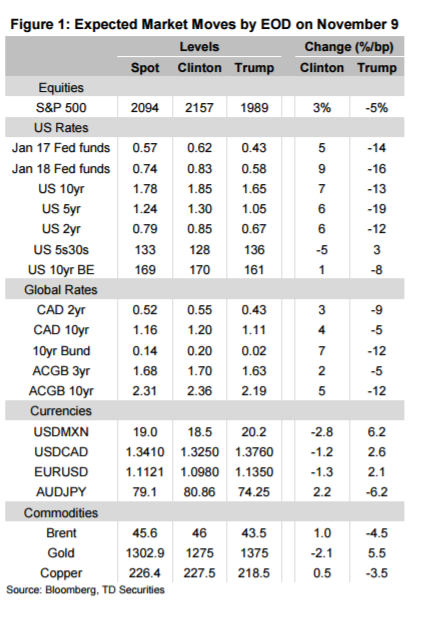

In a Clinton victory, we would see Fed funds repricing December odds to around 85%, 10yr UST yields up 8bp and the curve bear flattening, underperforming other G10 rates markets, the USD mildly stronger with USDMXN 3% lower and USDCAD 1.2% lower, and a small rally in oil and base metals.

In a Trump victory, we see December 2016 FOMC odds re-pricing to 20%, 10yr UST yields down 12bp in a bull steepening, the USD weaker with USDMXN 6% higher and USDCAD and EURUSD about 2% higher, while oil and base metals fall around 4%.