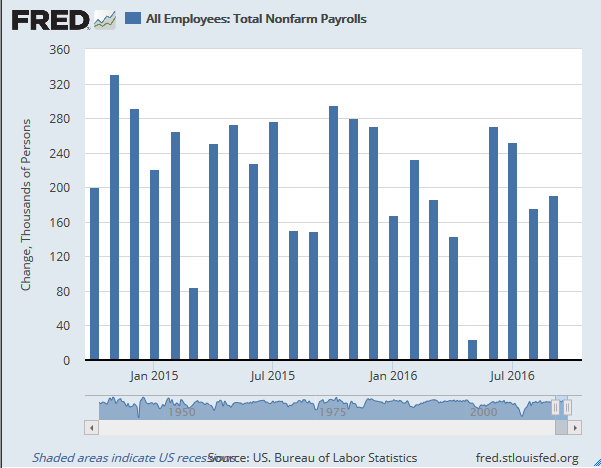

Friday’s payrolls report from the Bureau of Labor Statistics showed another month of solid job growth. According to official data, the US economy added 161k jobs in October. This was lower than the median forecast estimates of 174k. But previous revisions to August and September payrolls saw a combined increase of 44k, putting September’s payrolls from the originally reported 156k to 191k.

US Total Nonfarm payrolls: 161k, October 2016

The US unemployment rate was back at 4.9%, and this time around the participation rate fell to 62.8% from 62.9%.

Average hourly earnings rose 0.4% on a month over month basis, pushing the annual average hourly earnings to 2.8% in October. This was the strongest annual wage growth since June 2009. Economists were expecting to see wages rise 0.3% during October.

Job gains were recorded across most sectors in October with the exception of manufacturing, retail trade and mining and logging sectors.

Earlier in the week, the US ADP private payrolls data showed a lackluster print. According to ADP/Moody’s Analytics, the private sector in the US added 147k jobs, lower than the median estimates of 166k. But September’s ADP payrolls were revised higher to show 202k jobs, up from initial reports of 154k.

Some analysts had pointed out that historically, September payrolls were known to be revised higher. Analysts at CitiFx caution on this, as reported in our monthly NFP preview. “Historically, the September jobs number has had the highest largest upward revision from the initial print,” CitiFx analysts noted.

Wage inflation strengthens Fed’s case for December hike

The increase in average earnings, which now stands at 2.8%, the highest since June 2009 is likely to factor into the market expectations for a Fed rate hike in December. Inflation had been a sore issue for Fed officials but according to the latest FOMC statement released last week, the Fed’s language was seen as being more upbeat.

“The Committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives,” the FOMC statement showed.

The October payrolls report is the first of the two jobs report that the Fed will assess before the December 13 – 14 FOMC meeting.

The Fed’s outlook on the labour market continues to remain strong. “Although the unemployment rate is little changed in recent months, job gains have been solid. Household spending has been rising moderately, but business fixed investment has remained soft. Inflation has increased somewhat since earlier this year but is still below the Committee’s 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports,” the statement showed.

The quarterly nonfarm productivity data was also positive, rising 3.1% at an annual rate in the third quarter. This was higher than the median estimates of 2.1%.

US elections to overshadow economic data for the time being

While the US economic data has been broadly consistent, supporting the view for a rate hike in December, the US dollar has remained subdued. Investors will look to the US elections due on Tuesday, November 8th. The broader spectrum of the markets has already moved into a risk-aversion mode, and this theme is likely to continue until the election results are announced on November 9th.

WSJ US Dollar Index, week ending Nov 4th, 2016

With the exception of the US elections, the week ahead is relatively quiet with no major economic releases, leaving us the weekly jobless claims and next Friday’s UoM consumer sentiment.