Dollar/yen is already topping 109 but there may be more room for rises. However, EUR/USD could be limited. Here is the view from Morgan Stanley:

Here is their view, courtesy of eFXnews:

USDJPY support from all sides:

Crossing through a previous high at 107.49, we foresee an initial target of 112. We have often said that higher inflation expectations or steeper yield curves would have been required for USDJPY to turn around. However, the reason for steepening didn’t need to come from the Japanese side. The correlation between global bond markets is high, meaning the US 2s10s curve hitting the highest level this year has spilled over into the Japanese curve steepening too. Steepness has been focused on the shorter end of the curve (<10y) as the BoJ’s QE purchases are likely to be largest here, adding to JPY weakness.

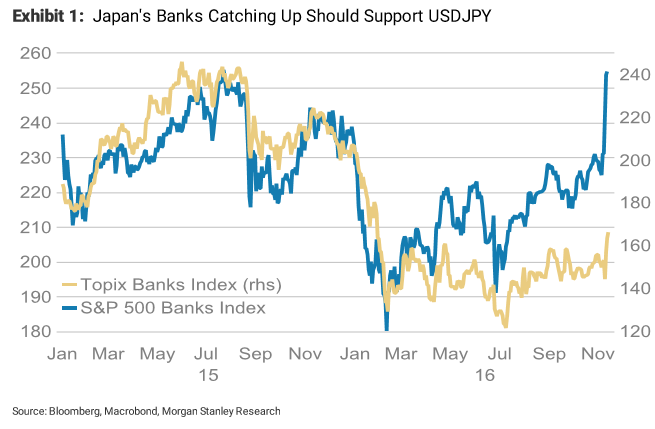

The Exhibit below shows that Japan’s TOPIX banks index still doesn’t reflect this new curve dynamic and has been underperforming US banks. Japan’s 3Q GDP beating market expectations, rising by 0.5%Q (0.2%Q expected) due to stronger net exports, suggests that a recovery is under way here, which counterintuitively is negative for the currency as more capital is exported abroad. Japan’s 10y real yield falling from -0.28% for -0.47% today while US real yields rise has supported USDJPY too.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

EURUSD downside limited:

As the market prices in a faster pace of Fed hikes due to expectations of higher growth and inflation, there could also be debates forming about whether the ECB will need to extend its QE programme beyond next year. The US 5y5y inflation swap has hit the highest level this year at 2.47%, allowing the eurozone’s equivalent measure to also rise to 1.55%. We expect EURUSD to find support around 1.07.

The real yield differential between the eurozone and the US remains relatively supported, which we think should limit outflows from the eurozone.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.