EUR/USD bounced from the double bottom but has not given up on dropping. The team at Deutsche Bank lists three reasons why the pair could go all the way to parity.

Here is their view, courtesy of eFXnews:

We are feeling increasingly confident that EUR/USD will break out of its 1.05- 1.15 range and trade through parity next year.

First, it is high time EURUSD started to move again. The duration of the current lack of trend is approaching a record high.

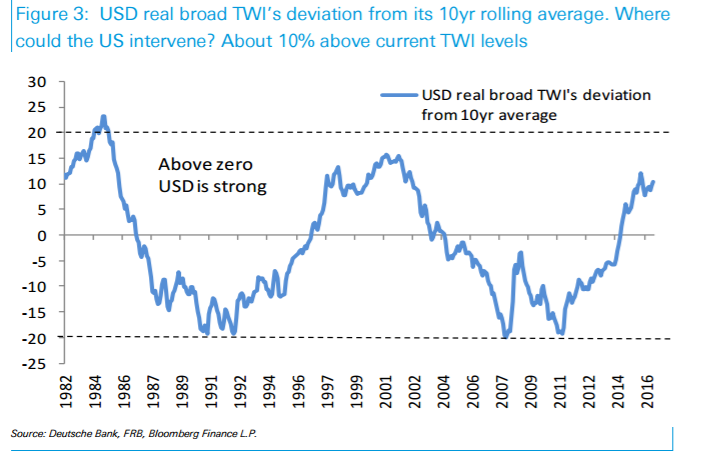

Second, the dollar is approaching its sweet spot for a late-cycle rally. Big dollar moves are less dependent on the change in short-end yields but on the absolute level: whenever the dollar becomes a top-3 G10 high-yielder it rallies as yield-seeking inflows return. A Fed rate hike this December will make the dollar the third highest yielding currency in the world, a strong dollar positive.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Finally, divergence is back. Even before Trump, the risks to US growth were tilted to the upside (chart 3). More fiscal and regulatory easing would add further upside risk to the growth and Fed outlook. Meantime European risks are tilted to the downside given a deteriorating credit impulse and political outlook. The recent rise in European real rates increases the odds of a more dovish ECB in the December meeting.

DB targets EUR/USD at 1.00 by the end of Q2′ 17, at 0.98 by the end Q3′ 17, and at 0.95 by the end of Q4 ’17.