GBP/USD seems to have found some stability. However,the team at Bank of America Merrill Lynch lists three reasons for seeing a dip to lower ground:

Here is their view, courtesy of eFXnews:

The consolidation in GBP that we had anticipated into year-end has materialized and has been given a boost following the election of Donald Trump. Since hitting a new multiyear low in mid-October, the GBP trade-weighted index (TWI) has rallied by nearly 5% and has been the best performing currency over the past month. In the absence of any incremental new information on the Brexit process, we had highlighted that extreme short positioning and maximum bearishness presented asymmetric upside risks for GBP and that has materialized.

We identify three main catalysts for this squeeze but continue to believe that GBP/USD will mark a new low in Q1 2017: data has remained robust; the UK government losing the Judicial Review on the right of Parliament to vote on Article 50 (A50); and a more balanced assessment from the Bank of England at the November Quarterly Inflation Report and the UK rates market pricing in a high probability of a rate hike by mid-2018. Sterling developments will continue to be dominated by the politics into the end of the year, notably the Government’s appeal on the Judicial Review verdict which is due to be heard by the Supreme Court at the start of December. A verdict is unlikely before the end of the year, but the government has insisted that it intends pressing ahead with the triggering of A50 before Q1 2017. We tend to agree.

In our view, the market is not positioned for the formal activation of A50. We believe that activation will happen, with or without Parliamentary activation.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Forecasts: $1.15 still remains the trough.

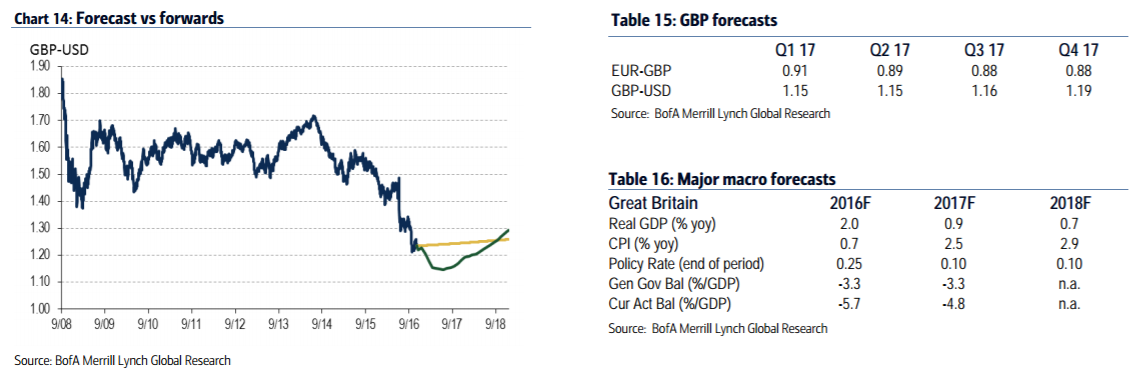

In line with our broader forecasts changes, our GBP/USD forecast profile has been lowered into 2017. We still look for GBP/USD to mark a cycle low of $1.15 in Q1 but to recover into the end of that year.

The EUR/GBP forecast profile has been lowered in recognition of the rising political risks in Europe over the coming year.

Risks: Have we seen the low in GBP? We believe that the risks to GBP are asymmetrically skewed to the upside. The market remains short and sentiment is overwhelmingly bearish. This leaves the pound susceptible to a recovery for a variety of reasons: continued strength in UK data; the Bank of England resisting the need for further easing and a more conciliatory backdrop to Brexit negotiations.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.