USD/CAD is stuck between Donald and oil. Which factor will win? The team at Bank of America Merrill Lynch assesses the situation:

Here is their view, courtesy of eFXnews:

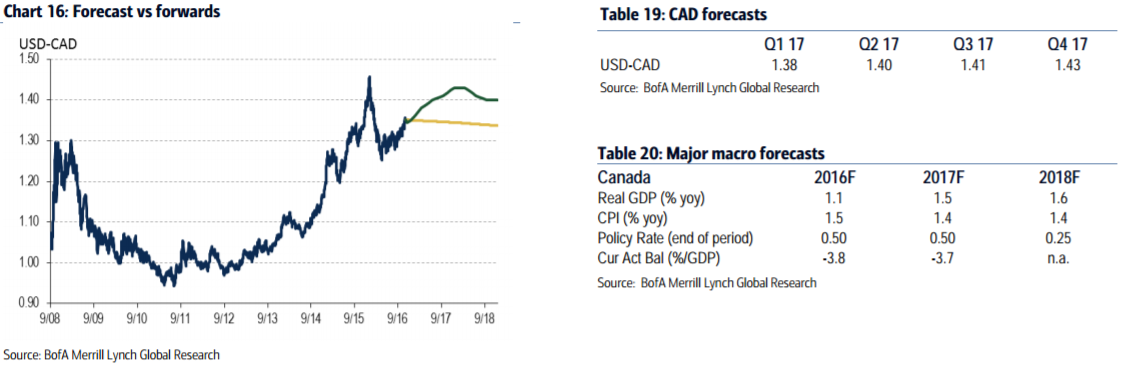

Themes: rates trump oil. We pushed up our USD-CAD forecast sizably, and now expect 1.43 at end-2017. The shift in view reflects several developments:

First, Donald Trump’s election increases the risk that NAFTA will be renegotiated or scrapped. The latter is unlikely, but given 23% of Canadian GDP is comprised of trade with the US, any developments along these lines will be CAD-negative. The economic risks are not adequately priced by the market, in our view.

Second, we now see the Bank of Canada cutting rates, potentially as soon as midyear or later, as growth remains lackluster and downside risks are growing.

Third, on the USD side, the GOP sweep opens up the door for dollar-positive fiscal stimulus, raising the prospect of a faster pace of Fed hikes. The market’s mispricing of BoC cuts relative to our forecast (3bps of cuts through mid-year 2017) and the extent of Fed hikes will leave the rate-sensitive Canadian dollar vulnerable during 2017.

Lastly, while our Energy team sees oil prices higher in 2017, uncertainty is high heading into the November 30th OPEC meeting. Risks are skewed towards lower prices if OPEC retreats from its previously agreed production cuts.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Risks: more balanced risks There are a few key risks to our bearish CAD stance. First, while we now see a BoC cut in 2017, a significant fiscal-driven boost to US growth could have positive spillovers to Canada. Given Canada’s lower sensitivity to US growth now we don’t think this would be a game change, though it is a risk. Second, higher oil prices on back of more disciplined OPEC production cuts or positive spillovers from US fiscal spending would support CAD more than we currently anticipate. Lastly, if USD gains turn the Fed more dovish, the policy divergence theme could be less positively USD/CAD than currently anticipated.