The Australian dollar was vulnerable today due to unexpectedly soft macroeconomic data. The currency logged a decline, though has trimmed it against some of rivals by now. Australian building approvals fell 8.7% in September from August after declining 1.8% in the previous reporting period. The drop was far bigger than the forecast 2.8%. Yesterday, the Aussie rallied as the Reserve Bank of Australia showed no intention to cut interest rates further, … “Unexpectedly Steep Drop of Building Approvals Makes Aussie Soft”

Month: November 2016

FOMC unexpected to rock the boat – three opinions

The November Fed decision is not expected to make huge changes before the elections and as no press conference is scheduled. Here are three opinions: Here is their view, courtesy of eFXnews: Nov FOMC: No Surprise; Little Change Only In First Paragraph – Nomura We expect the FOMC to leave the federal funds rate target range unchanged … “FOMC unexpected to rock the boat – three opinions”

Short AUD/JPY Or CAD/JPY Remain Good Proxy Hedges To US

The US elections are less than a week away, with worries of a Trump victory hurting the US dollar. The team at TD moves away from the greenback to the safe haven yen vs. commodity currencies: Here is their view, courtesy of eFXnews: The US election has also captured market participants attention recently. The chart … “Short AUD/JPY Or CAD/JPY Remain Good Proxy Hedges To US”

GBP/USD: Trading the British Services PMI

UK Services PMI is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 9:30 … “GBP/USD: Trading the British Services PMI”

EUR vulnerable if Angela Merkel hangs the towel –

EUR/USD enjoyed the FBI Effect and moves on Draghi as well. But what about German politics? The team at Deutsche Bank analyzes the political risk coming from the euro-zone’s largest economy: Here is their view, courtesy of eFXnews: The market may be underestimating the risk of German Chancellor Merkel deciding not to run again in the … “EUR vulnerable if Angela Merkel hangs the towel –”

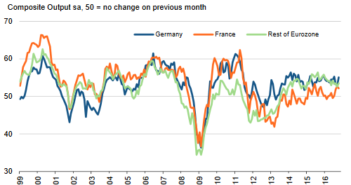

German growth leads Eurozone expansion; manufacturing outperforms services

Flash PMI data released last week from IHS Markit suggested that economic recovery in the euro area strengthened in October, largely due to the increase in the manufacturing sector. The Purchase Managers Index (PMI) released by IHS Markit showed the composite output index rising to 52.7 in October, marking a 10-month high and follows up … “German growth leads Eurozone expansion; manufacturing outperforms services”

Australian Dollar Records Limited Gains Despite Supportive Data

Australiaâs dollar started November off with gains against the US dollar as markets speculate that the Reverse Bank of Australia could be moving away from reducing its interest rates any time soon. The nationâs central bank took a decision earlier today to maintain its interest rates without any changes at 1.50%, stating strong conditions in the labor market, improved commodity prices and the stable economic situation in China as the main … “Australian Dollar Records Limited Gains Despite Supportive Data”

Dollar Falls as Political Uncertainty Shadows Recent Gains

The US dollar took a negative turn today after an increase in tradersâ demand for gold as a safe haven prior to the presidential elections in the USA, which is due to happen on November 8. Political uncertainty increased in the worldâs biggest economy after the FBI said itâs investigating new emails related to Hillary Clintonâs use of a private server when she was the secretary of state. The statement decreased Hillaryâs lead over Donald Trump to be as small … “Dollar Falls as Political Uncertainty Shadows Recent Gains”