A Draghi drag or top-tapering? This is our preview and we continue bringing you other views. Here is the one from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

Based on fundamentals, the ECB policy decision to continue its loose monetary policy stance should not be in doubt. As we noted, Euro area core inflation is as low as the last time the ECB extended QE. The latest increase in headline inflation is mostly driven by oil prices and base effects and still leaves inflation well below the ECB target. Moreover, QE extension should be easy to achieve, simply with some tweaks, particularly as more bonds qualify after the recent sell-off in rates.

However, we see risks of weak forward guidance that could disappoint FX markets. Recent headlines point to strong disagreements within the ECB on what to do next. This suggests to us that extending QE again without papering next year could be much more difficult, particularly if this requires relaxation of the capital key.

Our economists expect QE extension without tapering this week, but Draghi may not be able to give a strong message on the ECB commitment to QE for next year, making the current QE extension less effective with markets.

Markets could test the ECB, as they did with the BoJ early this year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

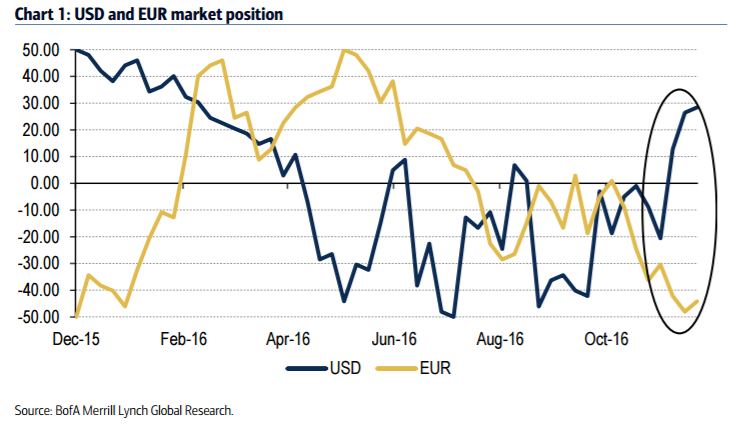

The initial EUR weakness if the ECB extends QE without tapering this time may prove an opportunity to buy, particularly if it triggers profit taking. Our latest positioning analysis suggests that the market is short EUR/USD, although not by as much as a year ago (Chart 1). This position could explain why EUR has not followed the JPY lower during the USD rally last week making it more difficult for the ECB to being the currency further down. Weak ECB forward guidance could squeeze the short EUR position higher.