More responses come after the ECB’s big QE extension move. What’s next?

Here is their view, courtesy of eFXnews:

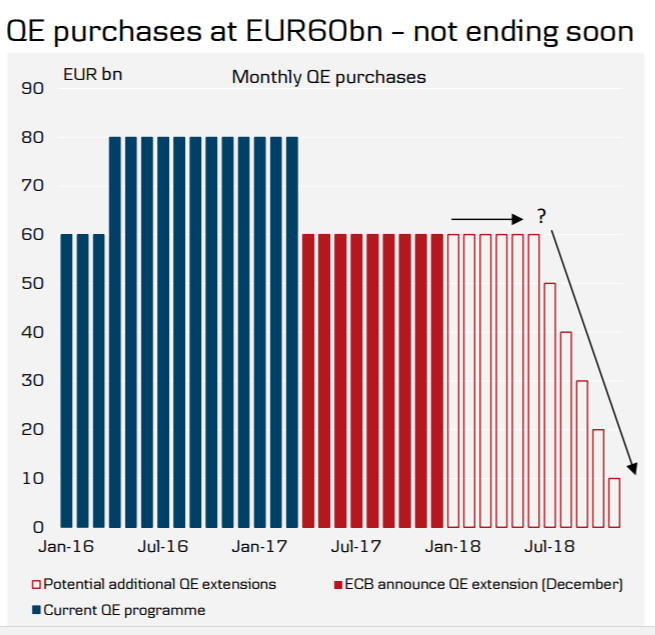

The ECB extended its QE purchases by nine months to December 2017, but reduced the monthly purchases to EUR60bn from EUR80bn. The lower pace of purchases followed, according to the ECB, as the risk of deflation has now largely disappeared (the reason why the pace of purchases was temporarily lifted). President Draghi said the nine-month extension followed, as the ECB wants to signal a sustained presence and no near-term tapering.

Draghi expressed a very dovish tone during the Q&A and continued to repeat that tapering had not been discussed.According to Draghi, none of the ECB members want to taper QE, but the main message was a sustained ECB presence in the markets without distortions. Related to this, the ECB communicated additional flexibility in case of a less favourable inflation outlook or a worsening in financial conditions.

The market seemed to ‘accept’ that the lower QE purchases do not imply the ECB is on a tapering path. This should be seen in light of Draghi’s dovish stance including the comments that the new inflation projection is ‘not really’ close to the 2% target and that the ECB does not have the ‘luxury’ to consider lowering its purchases further.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

EUR/USD initially bounced on the ECB announcement but fell thereafter when the market realized that the policy change was in a more dovish direction than it initially appeared. At the press conference, Draghi clearly struck a dovish tone, stressing that sustained ECB presence in markets is the main message.

Near term, we see EUR/USD in a 1.05-1.10 range with the balance of risks skewed towards a break to the downside. As such, EUR/USD is a sell on rallies within the 1.05-1.10 range.

We forecast EUR/USD at 1.05 in 1M and 1.04 in 3M before a sustained move higher to 1.08 in 6M and 1.12 in 12M.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.