The British pound did lose some ground against the US dollar, but did not suffer the fate of the euro or the yen. The team at Barclays sees moderate appreciation for sterling:

Here is their view, courtesy of eFXnews:

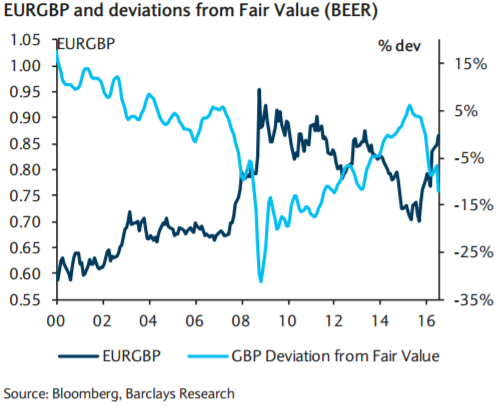

A period of relatively little economic data and elevated European political risks will likely offer a chance for moderate sterling appreciation versus the EUR, in our view. Sterling’s undervaluation (based on our BEER model and other indicator) and the UK’s relative immunity to the Politics of Rage in continental Europe should also contribute to modest EURGBP depreciation.

We no longer expect additional BoE easing. While this is already priced by the market, it confirms our view that BoE policy will not be a source of GBP weakness in the coming quarters. At the December meeting, the MPC acknowledged that recent developments (including modest GBP appreciation in NEER terms) made a marginally lower path for inflation more likely, alleviating some pressure to act in the short term. Furthermore, there has been a tendency for US and UK short-term rates to display a positive correlation, leaving the GBP among the least vulnerable of its peers to further USD strength, in our view.

On the data front, the final release of Q3 GDP (Friday) should confirm the preliminary print (previous: 0.5%; consensus: 0.5%) and we do not expect it to be particularly market moving for the GBP.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.