The US dollar dropped against other most-traded currencies today as traders were taking profits at the start of the new month that followed November, which was a very good month for the US currency. The US dollar has started a rally in the first half of November, and the currency accelerated its move to the upside after November 9 when Donald Trump won the presidential race. Now, traders are locking in profits following the impressive rally. … “Dollar Sinks as Traders Take Profit”

Month: December 2016

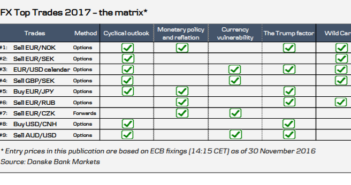

Position For 2017: 4 Themes, 9 Trades, 1 Wild-Card –

As December begins, many are already eying the next year: 2017. The team at Dankse has you ready with 4 themes, 9 trades and 1 wild card: Here is their view, courtesy of eFXnews: We present our year-end FX Top Trades for the coming year. We base the 2017 publication on four themes we think will drive … “Position For 2017: 4 Themes, 9 Trades, 1 Wild-Card –”

Canadian Dollar Continues to Receive Support from Skyrocketing Oil Prices

The Canadian dollar continued to rally against its major rivals today, demonstrating especially big gains against the weak US dollar, as the OPEC oil production cut propelled oil prices higher. Yesterday’s deal to reduce oil output achieved by members of the Organization of Petroleum Exporting Countries led to a sharp rise of prices for crude. Many skeptics did not believe that such an accord could be achieved, yet not only … “Canadian Dollar Continues to Receive Support from Skyrocketing Oil Prices”

British Pound Climbs Higher on Possible Single Market Access

The British pound traded at its strongest level against the euro since September 6 on Thursday. The sterling received a positive lift from news of possible budget contributions that the United Kingdom might be willing to offer the European Union to keep its access to the single market. In a statement that was made earlier today, Secretary of State David Davis said that the UK is willing to support the budget of the European Union in exchange … “British Pound Climbs Higher on Possible Single Market Access”

EUR/USD: Trading the US Non-Farm Payrolls

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background … “EUR/USD: Trading the US Non-Farm Payrolls”

Australian Dollar Unable to Maintain Upward Momentum

The Australian dollar failed to maintain its rally despite relatively supportive macroeconomic data, both domestic and overseas. The Australian currency demonstrated the performance which was rather similar to that of its New Zealand counterpart — an attempt to rally intraday, but a failure to maintain gains. As for economic reports from Australia, they were rather good, with the exception of private capital expenditure that showed a 4% drop in the third quarter of this year … “Australian Dollar Unable to Maintain Upward Momentum”

New Zealand Dollar Fails to Rally Despite Data from China

The New Zealand dollar slipped against most major currencies today (though not against the US dollar) as relatively positive data released from China failed to bolster the currency of its trading partner. China’s official data showed that manufacturing Purchasing Managers’ Index rose from 51.2 to 51.7 in November, exceeding market expectations and demonstrating the second month of increase. Meanwhile, the private Caixin report showed a small drop to 50.9 … “New Zealand Dollar Fails to Rally Despite Data from China”

After OPEC: new oil targets from two banks

After OPEC reached an ambitious deal, oil prices held up to their previous gains and could now continue higher. But where to? Here are two opinions? Here is their view, courtesy of eFXnews: OPEC Deal: First Reaction On Targets For WTI Oil Prices – CIBC It appeared that Saudi Arabia was taking a different tact … “After OPEC: new oil targets from two banks”