One of the proposals under consideration by the incoming Trump administration is a border tax. How will this impact the US dollar? And against which currencies?

Here is their view, courtesy of eFXnews:

A new HIA and other corporate tax reform has received quite a bit of attention but we think “border adjustments” could have vast market implications

Border adjustments would likely redraw the boundaries around foreign trade, sparking global concerns about protectionism and unfair trade

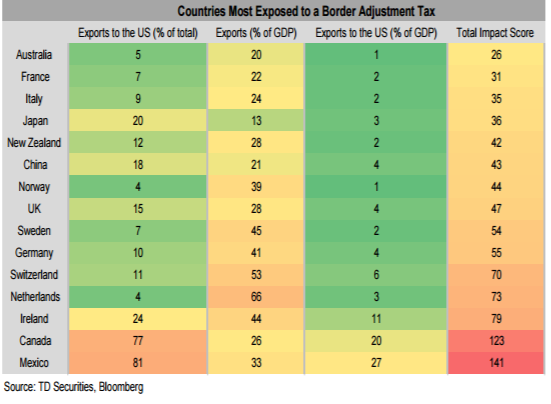

The market implication would hinge on the linkages between the US and its trading partners. This leaves CAD and the EUR the most vulnerable major currencies to the passage of this tax reform.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

In our view the USD is likely to absorb about half of the cost f the tax and could rally another 10% in broad terms. The major currencies most at risk at the ones that score the worst on our Total Impact Score—notably, CAD and EUR. These countries have supply chains that are closely linked with the US, leaving their currencies to bear some of the brunt of a shift in prices.

To put this in context, another 10% rally in the Fed’s Broad USD TWI over the next year pushes USDCAD into the mid-1.50s and EURUSD below 0.90.

These levels are not forecasts. The magnitude of exchange rates adjustments will likely differ given the fluidity of FX markets and the elasticises to trade. Still we think they offer reasonable benchmarks for direction on a border adjustment tax. Also keep in mind that this policy will not operate in a vacuum. It is more likely that central bank policy, corporate tax reform and possible retaliations from trading partners are some of the factors that could mitigate exchange rate adjustments.