GBP/USD reached new lows at the 1.20 handle, but bounced quickly, thanks to Trump. What’s next?

Here is their view, courtesy of eFXnews:

2017 has already struck a shrill chime for the pound. The market interpreted PM May’s interview on Sunday as a re-alignment with her tough tone at October’s Conservative Party conference, and a move away from the softer stance hoped for after she discussed the possibility of a transitional deal in December. May’s apparent reluctance for “keeping bits of the EU” (such as single market access) and her focus on ensuring “the right relationship, but when outside the EU” helped push GBPUSD back to October 2016 lows this week below 1.22. However we note that GBPUSD implied volatility and risk reversal skews have only modestly moved through this week’s episode – and there are tentative signs that even GBPUSD spot is stabilizing, at least for the very short-term.

Uncertainty ahead of other two important political events could be the cause of this pause – both of which have no date set but are due by the end of January.

The more impactful of these will be PM May’s much-anticipated speech detailing steps after triggering Article 50; here it seems particularly difficult to guess the likely scenarios or reactions.

As for the UK Supreme Court’s Brexit case verdict, while this may generate some brief noise, we expect it to broadly be a non-event in the grand scheme of things Brexit. Firstly, the UK Government has now had ample time to prepare for a verdict in either direction, with some officials already suggesting a quick and calculated response is in the pipeline. Secondly, the fact that UK Parliament has already informally hinted that it would vote through the triggering of Article 50 suggests little material impact from this one event. Even if the UK Government were to lose the court case, this episode may only prove to be a minor irritant that may not necessarily delay the timelines already set.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The market seems most uncertain on exactly what to expect from PM May’s upcoming speech. If her reaction after Sunday’s interview is a hint to go by, she could choose to take a more cautionary approach in her next speech by consciously staying vague – and simply refraining from mentioning any isolated topics like single market access. While it is true that a ‘vague scenario’ is unlikely to trigger an aggressive GBP reaction, we still expect a negative asymmetry for the pound even if PM May keeps her cards close to her chest. The risk is that the market now becomes more frustrated or impatient – or even begins to question the UK Government’s competency in agreeing on any credible Brexit strategy.

What seems harder to envisage is how GBPUSD could rally on such a speech, especially when PM May has faced strong criticisms for being indecisive and flippant in her narrative. With a major shift in tone unlikely, some more subtle bullish scenarios could be if single market access is now mentioned by name, or if there a higher degree of clarity about a transitional deal, or if she now talks more about trade than immigration.

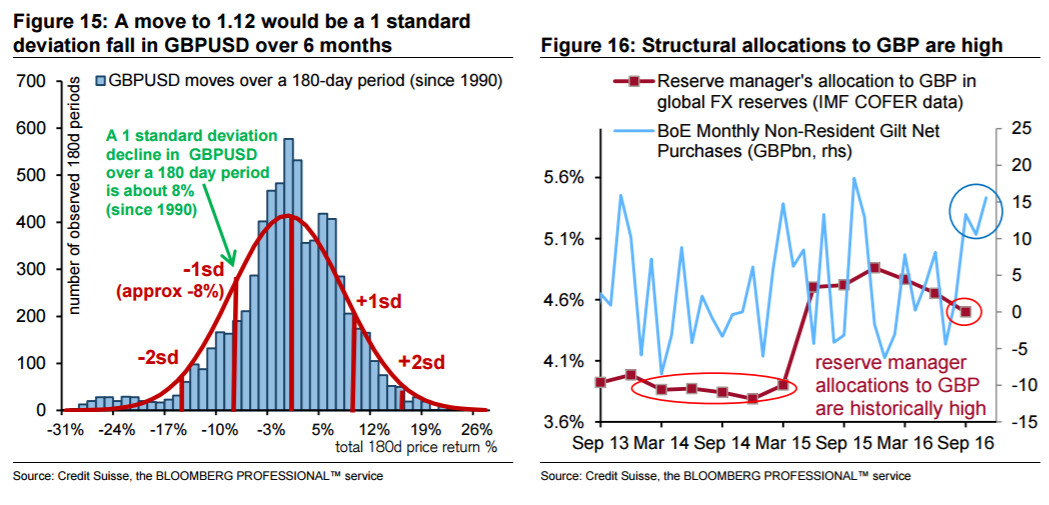

In the most bearish scenarios, we would not rule out the risk that PM May tries to emphasize controlling immigration as her absolute top priority. GBP has scope to weaken further particularly because we do not believe positioning is especially stretched on all accounts. As Figure 16 shows, broader indications of positioning (such as central bank FX reserve allocations and foreigners’ gilt holdings) have still offer scope for reduction. And if history offers any guide, we would not be surprised if such a tone starts a move lower in GBPUSD towards the 1.10 or 1.12 level in 6 months if still higher odds of “hard Brexit” are priced in. This is roughly the 1 standard deviation downside move in cable over a 180 day period since 1990.

For now, we retain our long-held GBPUSD 1.20 3m target until we get more clarity.

As a technical-based trade, CS maintains a short GBP/USD from 1.2230.*

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.