It is not always about fundamentals and technicals, but rather flows. Treasuries could have a significant impact on EUR/USD:

Here is their view, courtesy of eFXnews:

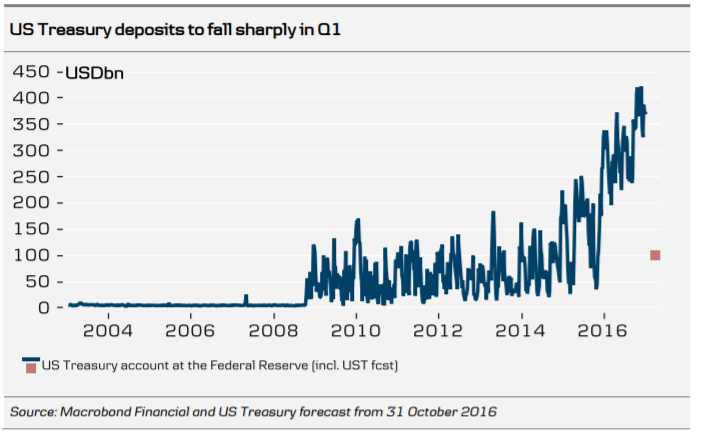

The Treasury expects to draw down USD290bn from its deposits in Q1, which will add a corresponding amount of USD to the market. This amounts to a 9% increase in the monetary base.

If the US debt ceiling is not re-suspended or increased above the present debt level before 15 March, the cash buffer may be drawn down further to around USD23bn adding about USD80bn more to the market.

Since the US Treasury has committed to keeping a cash buffer of around USD500bn, a near-term fall in deposits would be rebuilt over the medium term.

The USD cash deluge is near-term negative for the USD, but not enough to offset support vis-à-vis EUR and Scandi currencies from relative rates and growth.

We forecast EUR/USD at 1.05 in 3M. Medium and long-term we are bearish USD and forecast EUR/USD at 1.12 in 12M.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.