EUR/USD went up on the Trump Dump and now looks expensive according to the team at Credit Agricole. What’s next?

Here is their view, courtesy of eFXnews:

The latest rebound in EUR/USD is driven by a positioning squeeze of USD longs on the back of policy uncertainty returning in the wake of Trump’s inauguration.

At the same time, there is little to suggest that the FX move has a more solid, fundamental underpinning.

Indeed, there is little indication that the market views on the policy divergence between the hawkish Fed and the dovish ECB have been affected by concerns about rampant US protectionism or delayed fiscal stimulus.

In addition, various metrics still suggest that the political risks in the Eurozone remain unabated ahead of the elections in the coming months. These are likely to keep investors fairly cautious on the outlook for the single currency.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

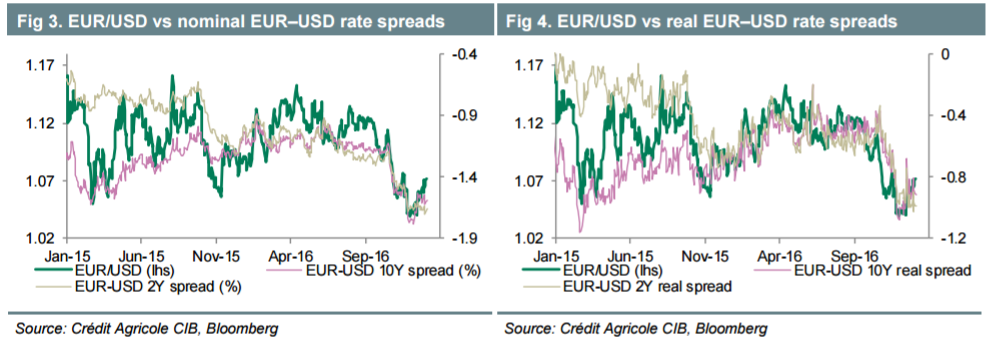

Our valuation analysis suggests that EUR/USD is starting to look fairly overvalued compared to fundamental drivers like rate spreads and measures of EGB credit risks.

The results suggest that the room for further appreciation is now limited while a renewed test of the lows below 1.05 is a growing downside risk.

Short EUR positions are starting to look attractive. However, given that political risk in the US is, at least for now, weighing on the USD, shorts may be better expressed against JPY.

We recommend selling EUR/JPY via options buying a EUR/JPY 4M 1×1.5 ratio put spread with strikes at 118/115 for a cost of 0.1020% on notional of EUR30m.