EUR/USD enjoyed a relatively stable week. The team at SEB sees a selling opportunity on a rally:

Here is their view, courtesy of eFXnews:

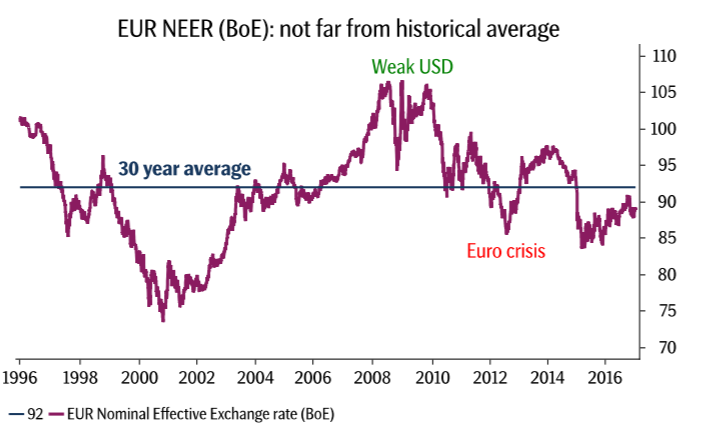

EURO NOT READY FOR A SUSTAINABLE RALLY. The outlook for the euro remains negative, consensus projects EUR/USD to trade lower near parity during H1 2017. We agree, but the market is also clearly positioned for a weak euro -> we expect EUR/USD to rally short-term up towards 1.10 as USDpositioning looks stretched. EUR/USD remains a sell on rallies.

SHORT-TERM: Economic growth is recovering, and the euro area is expanding just above trend. Unemployment is falling, and inflation is slowly rising. We think it likely ECB will continue its QE-program throughout 2017 but that Mr. Draghi may well taper the current pace of purchases further (currently EUR 60bn/month from April). The policy divergence vs. a hiking Federal Reserve remains a relevant (negative) driver for the euro in the coming year. QE policy has likely contributed to making global reserve managers cut the fixed income holding of the euro-zone (large net bond outflows 2015/16), in turn boosting already significant imbalances in the Target 2 system. Furthermore, the current account development (increasing surpluses) is driven almost exclusively by German exports (hence not that strong a supportive euro factor). These factors show that large internal euro-zone imbalances and problems still exist. Political elections in 2017 risks boosting already elevated risk premia in the euro-zone furthermore.

LONG-TERM: The institutional crisis and imbalances that the euro-zone finds itself in, motivates a weak euro for long. Appetite for European assets will be low and foreign capital likely to seek to hedge their euro exposures. We expect the euro trade-weighted currency to be a funding currency of choice in 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.