The Canadian dollar enjoyed the positive GDP number and the dollar fell on Trump. What’s next?

Here is their view, courtesy of eFXnews:

A healthy Nov GDP report underpinned CAD. The headline beat expectations coming in line with TD’s expectations of a 0.4% m/m gain. Under the hood, the goods-producing industries led the gains while services made a modest contribution. The improvement helped to fully reverse the slowdown from the prior month.

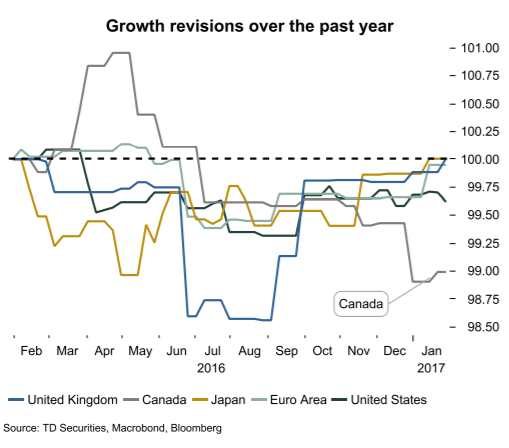

Even so, this report is unlikely to provide much relief to the BoC. The pickup in growth is coming from a very low base and the upside surprise largely reflects diminished expectations rather than an acceleration in growth. Indeed, the second chart shows indices that track economic growth revisions, highlighting that Canada has seen the sharpest deterioration in expectations of any of the major countries over the past year.

This leaves us to believe that the BoC will want to see more evidence of a sustained pickup in growth before changing its tone on monetary policy. Equally important, core inflation continues to decelerate, suggesting excess capacity in the Canadian economy.

In regards to CAD, we suspect the price action hinges on a mix of the sharp USD selloff and better data in Canada. We lean on the Trump-trade squeeze hypothesis and note that USDCAD is tracking 2sd cheap on our model.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.