The Trump Trade is beginning to become the Donald Downfall. What’s next?

Here is their view, courtesy of eFXnews:

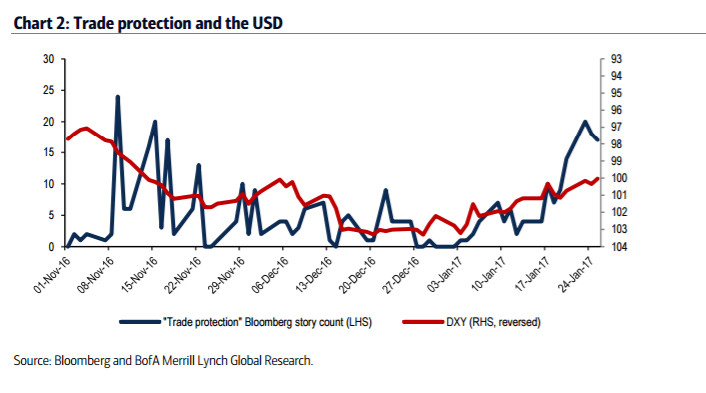

Markets are gradually getting concerned that the pre-election Trump and the postelection Trump may be the same person. One by one, President Trump seems to be carrying out his pre-election promises, some of which may not necessarily be seen as market-friendly. As a result, the gradual USD sell-off has continued this week, while US equities saw a correction from an all times high and volatility has spiked from historic lows. How far (and how literally) President Trump will go to some of his most controversial pre-election promises remain to be seen.

However, a number of forces may benefit the USD, fuelling a new rally in the next few months. We would expect a diminishing market impact from Trump headlines and tweets that are not directly market-relevant. Investors may also learn to differentiate empty from actual threats. President Trump has promised tax reform and a massive fiscal stimulus, all USD positive, promises that we would expect him to deliver, most likely as a package with the Congress approval of the debt ceiling. Paul Ryan’s plan includes a smaller fiscal stimulus, but still large, particularly for an economy already in full employment. The details of the Trump fiscal policies are also bullish for the USD, such as a new Homeland Investment Act and a Border Adjustment Tax.

As long as the US data remains strong and inflation on a rising trend, the Fed will hike at a pace closer to what the Dot Plot suggests. Indeed, we believe that we will soon shift from trading Trump headlines to trading the US data and US fiscal policy headlines.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Bottom line Our latest research suggests that:

1- Long USD/JPY* is the best G10 FX trade to express a bullish Trump (USD) view. However, long USD/JPY will also weaken the most if President Trump disappoints markets. We remain positive and would buy the USD/JPY dips.

2- Investors long in Trump trades who would like to hedge may want to be long USD against AUD, CAD and KRW. These trades can do well under most Trump scenarios.

3. Investors wanting to avoid the USD and Trump uncertainties can buy EUR/JPY. We have been long EUR/JPY in recent months. We note that the cross did well during the USD rally end-2016, but has not weakened during the USD sell-off so far this year. We expect higher inflation to increase the real rate differentials to the benefit of EUR/JPY, as the BoJ is more committed to continuing its accommodative policies than the ECB. Beyond the major G10 currencies, we still like SEK and NOK as a long-term view, but we are concerned about the market’s long positions.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.