USD/JPY has been trading at lower ground, but shows hesitation. What’s next?

Here is their view, courtesy of eFXnews:

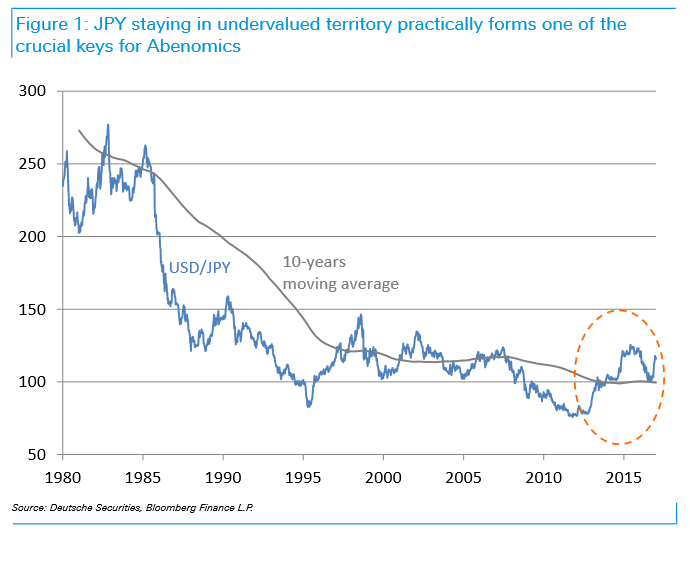

Prime Minister Shinzo Abe appears to be preparing pro-active proposals for President Trump to boost US growth and employment. If the Trump administration delivers on its promised aggressive fiscal policy, we can expect the current account deficit to widen (reflecting expanded domestic demand) and the dollar to strengthen owing to rising interest rates. If Japan’s proposals prove effective, we think they would be certain to at least reinforce this change. While President Trump will likely welcome Japan’s proposals, he will very likely hold dissatisfaction over the trade deficit against Japan and the weak yen.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

…We calculate that after correcting at the low 110 level recently, the dollar/yen cycle will move toward 120-125 as fiscal policy accelerates US growth to 3-4% from 2017 into 2818 and the Fed hikes policy rate repeatedly.

However, a level above 120 would be politically sensitive, and we cannot exclude the possibility that the Japanese authorities may start talking about self-restraint regarding yen depreciation before the currency reaches 120. Coming dollar/yen appreciation will unlikely be unidirectional.

We recommend building long positions by buying on decline strategically at around 110 and tactically at over-115 level.