The US dollar is not excited from Trump’s first weeks in office despite some hopes from tax changes. Nevertheless, the team at Goldman Sachs remains bullish on the greenback:

Here is their view, courtesy of eFXnews:

Markets are worrying over the “true” intentions of the new administration. Concern that President Trump is mercantilist and may talk down the Dollar has seen the Dollar fall notably below the 2-year rate differential, as markets have priced a protectionist risk premium.

Our last FX Views argued that this decoupling is unlikely to last, given that the correlation of the Dollar with front-end differentials is one of the more stable relationships out there.

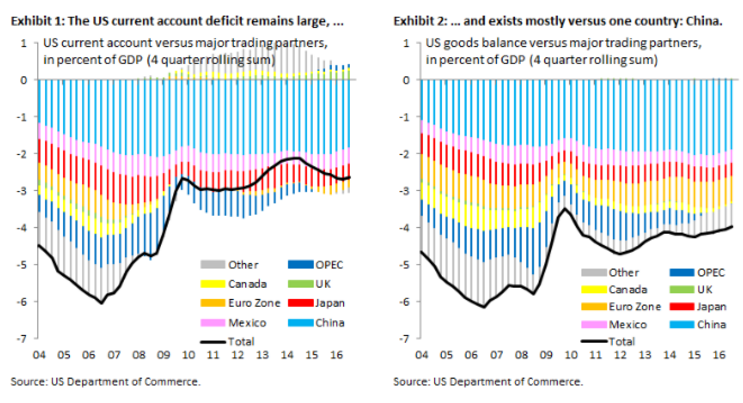

That said, today we examine the persistent and large US current account deficit, given that it is often cited as evidence that the Dollar is overvalued and needs to fall.

We argue that the current account deficit, which stands at 2.6 percent of GDP, is a flawed metric on which to make a valuation judgment for the broad Dollar. This is because the deficit is heavily skewed towards one country – China – which alone accounts for 1.8 percentage points, while Mexico, Japan and the Euro zone each play only supporting roles. The US current account deficit is therefore to a large degree a bilateral phenomenon vis-à-vis China, which also means that it bears implications not for the broad, trade-weighted Dollar but for $/CNY. We examine the implications that the bilateral current account has for the $/CNY exchange rate, concluding that – if the new administration wants to have a material impact on external trade – this is where its focus will ultimately have to be.

We remain firmly convicted RMB bears and, in the broader context, Dollar bulls.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.