EUR/USD managed to bounce from low support at 1.0520 after having dropped on good US data. What’s next?

Here is their view, courtesy of eFXnews:

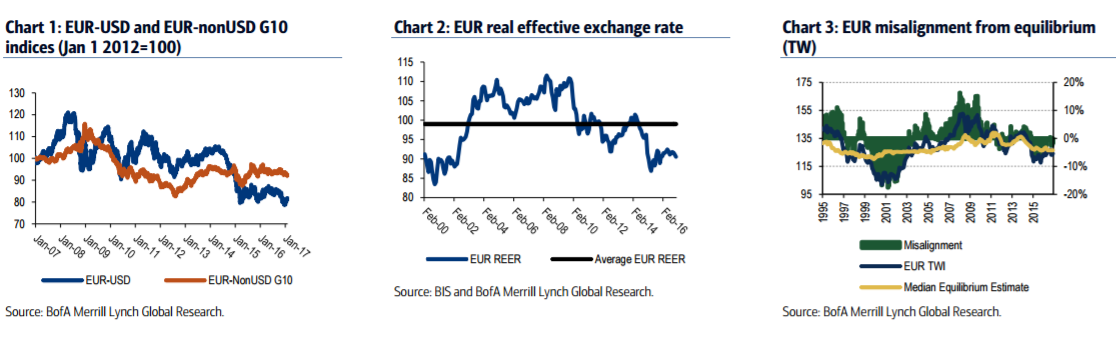

It is all about the USD and about President Trump’s policies for the EUR for now. Indeed, the sell-off of the Trump trades so far this year, following some profit-taking and market concerns for US trade protection, has supported the EUR. This is despite Draghi being dovish in the January ECB meeting and emphasizing the importance of core inflation for the ECB policy reaction function and also despite political risks in some Eurozone countries ahead.

We remain constructive on the USD, expecting the policies of the new US administration to focus more on fiscal stimulus and deregulation and less on trade protection. This explains our bearish EURUSD projections for H1.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

However, we expect ECB constraints to become a more important driver for the EUR in H2. The ECB minutes from the December meeting clearly reflected these challenges. The ECB is likely to announce QE tapering by the end of this year, as they appear unable to increase the issue limit or relax the capital key. Inflation is also on a rising trend, although to a large extent because of base effects. We therefore expect EUR/USD to gradually strengthen in the second half of the year. We are bullish EUR/JPY for the year, which is a good way to avoid US policy risks.

We expect EUR/USD to weaken to 1.02 by mid-2017. Risks to this projection appear balanced following the recent USD sell-off, as positioning is now cleaner. Expecting the ECB to announce QE tapering towards the end of the year, we see the EUR strengthening in H2, going back to 1.05 by end 2017 and to 1.10 in 2018, with upside risks.