EUR/USD has not always provided the “correct” reaction to economic data releases. What does it mean? The team at ANZ provides some answers:

Here is their view, courtesy of eFXnews:

The response in currency markets to data releases over the past week has been instructive in that it has been counterintuitive.

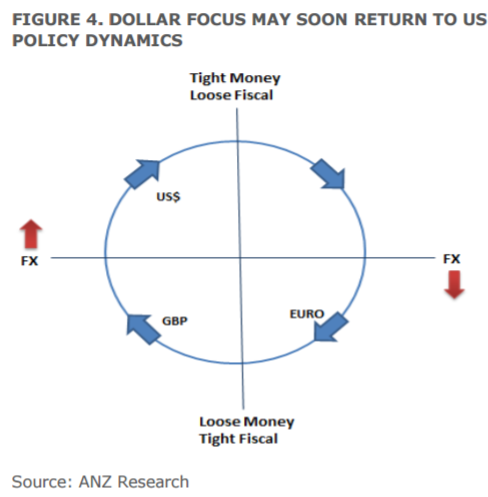

In the wake of better than expected US January retail sales data, February regional PMI numbers and a hawkish tilt from Fed Chair Janet Yellen, the dollar sold off last week. This week, the euro has sold off despite better than expected PMI data which imply that the momentum in the euro area economy is accelerating during Q1.

EUR/USD is oscillating and the price action would suggest that coincident data are not affecting central bank policy expectations at present.

Market positioning is dominating for now and the market is awaiting clarification on planned US fiscal initiatives.

….Our forecasts continue to anticipate gradual USD appreciation vs EUR in coming months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.