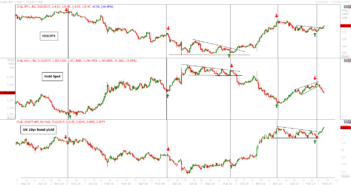

Intermarket analysis between USDJPY, Gold spot and the US 10yr yield.

As per charting, USD/JPY and bond yields exhibit a positive correlation. Gold & 10-year yield exhibit a negative correlation. Gold ad USDJPY exhibit negative correlation.

Since September 2015 this correlation strengthens and we can see on the chart that tops and bottoms formed precisely in the same magnitude.

Recently, all three asset classes have given a break from the patterns. After the observation, it seems that Gold gives the first indication for a change in trend and then it is followed by other two asset class.

So in the near term, dollar/yen will continue the uptrend and it could test the 117 and then 119 levels.

Yen depreciation is inevitable