The Japanese yen was firm today even though economic reports released from Japan on Monday were not particularly supportive, especially core machinery orders. The Producer Price Index rose 1.0% in February from a year ago after increasing 0.5% in January. It was in line with expectations, though economists claimed that the rate of growth remains unimpressive. But the really nasty surprise came from core machinery … “Japanese Yen Firm Despite Economic Data”

Month: March 2017

GBP/USD: as politics get messy, reality could begin biting

The fall of cable is not solely the outcome of the hawkish Fed. The back and forth on the Brexit Bill as well as some worrying signs about consumption. Is the weak pound taking its toll? If so, we are seeing a vicious cycle. After explaining the reasons for the fall, we move to discussing … “GBP/USD: as politics get messy, reality could begin biting”

ECB Hawkishness Makes Euro Strongest Major Currency

Markets did not expect anything particularly important from this week’s European Central Bank meeting, but it turned out to be perhaps the most important event during the week, making the euro the strongest major currency. Meanwhile, the highly anticipated US nonfarm payrolls turned out to be almost non-event, having negligible impact on markets. ECB President Mario Draghi was surprisingly hawkish at the press-conference that followed … “ECB Hawkishness Makes Euro Strongest Major Currency”

Canadian Dollar Hangs onto Gains After Solid Employment Data

The Canadian dollar rallied today following the release of solid employment data from Canada. The currency has trimmed its gains by now but is still trading above the opening level. The loonie’s performance against the euro was different, though, as the Canadian dollar was unable to rise against the shared 19-nation currency. Canadian employers added 15,300 jobs in February. While the increase was noticeably smaller than January’s 48,300, it … “Canadian Dollar Hangs onto Gains After Solid Employment Data”

Euro Rises Against Major Counterparts as ECB No Longer Worries About Deflation

The euro rallied against the US dollar, the British pound, and other major peers on Friday after the European Central Bank signaled that it no longer worries about deflationary pressures. The shared currency reached its highest point against the greenback in almost 2 months in todayâs trading. Following an update for his bankâs monetary policy, European Central Bank President Mario Draghi held a press conference, in which he said … “Euro Rises Against Major Counterparts as ECB No Longer Worries About Deflation”

US Dollar Disappoints Despite Strong Non-Farm Payroll Report

The US dollar’s performance was quite disappointing after the release of the non-farm payroll data by the Bureau of Labor Statistics, which exceeded expectations. Contrary to market expectations of a rally by the US dollar, the currency rallied briefly before retracing most of its gains, indicating that the markets had already priced-in the positive NFP. The US dollar rallied briefly as evidenced by the US Dollar Index, which rose to a daily high of 102.03, but later retraced … “US Dollar Disappoints Despite Strong Non-Farm Payroll Report”

GBP/USD Rallies Briefly After Release of UK Production Data for January

The GBP/USD today tested new daily highs after the release of the UK’s production data for the month of January by the Office of National Statistics. The currency pair started the day’s session trading in a range, but rallied higher after the release of the UK’s production data, which had mixed results. The British pound rallied against the US dollar, the euro and the Japanese yen after the release of the UK’s production data. The British pound’s rally was triggered by the UK’s … “GBP/USD Rallies Briefly After Release of UK Production Data for January”

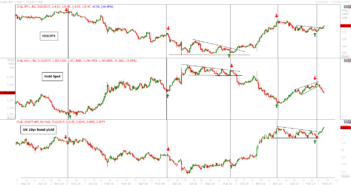

Yen depreciation is inevitable

Intermarket analysis between USDJPY, Gold spot and the US 10yr yield. As per charting, USD/JPY and bond yields exhibit a positive correlation. Gold & 10-year yield exhibit a negative correlation. Gold ad USDJPY exhibit negative correlation. Since September 2015 this correlation strengthens and we can see on the chart that tops and bottoms formed precisely in … “Yen depreciation is inevitable”

ECB’s hawkish twist – what’s next for EUR? – 3 opinions

EUR/USD managed to gain some ground after Draghi removed some urgency. What does this mean for the euro? Here are three opinions: Here is their view, courtesy of eFXnews: EUR: Here Is The Next Step From The ECB After the ‘Hawkish Twist’ – Danske The ECB kept all policy measures unchanged at today’s meeting, and … “ECB’s hawkish twist – what’s next for EUR? – 3 opinions”

British Pound Weakens to Lowest Level in 8 Weeks Against US Dollar

The British pound declined against the US dollar on Thursday, after concerns towards Brexit returned to the market as the end of the current month is expected to be the time when the government triggers Article 50. Chancellor of the Exchequer Philip Hammond released the spring budget of the United Kingdom yesterday, which did not contain mentions of Brexit. However, investors believe that the government is preparing plans to shape the economy of the nation after departing from … “British Pound Weakens to Lowest Level in 8 Weeks Against US Dollar”