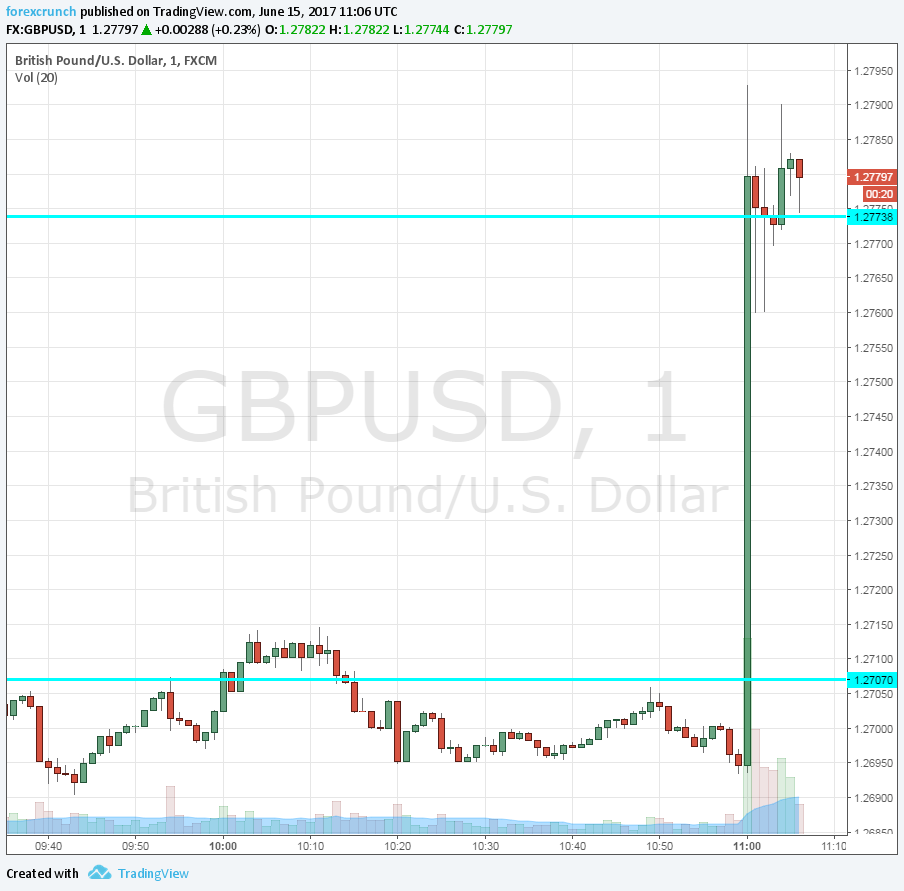

GBP/USD is up some 100 pips after the Bank of England made its rate decision. They have not changed the interest rate, but 3 out of 8 members voted for a hike. This is up from a lone dissenter in previous months and the reason for the rise.

Central banks often like to guide markets without having to act. Talk is cheaper than action. The Monetary Policy Committee is a group of independent individuals, some are internal BOE members and some are external. Or at least that’s what we think.

However, this 5:3 vote serves the BOE’s goals: the pound is higher, pushing the prices of imported goods lower and eventually inflation lower. Headline CPI is touching the upper limit of 3% which is the BOE’s target.

Yet raising rates would have not only pushed the pound higher but also made lending more expensive. The economy is already weak.

So, a stronger pound with low rates is the Goldilocks situation.

With the political uncertainty that still looms over the UK, it is not really the time to raise rates.

Was there a coordinated effort to threaten with a rate hike in order to goad the pound to higher ground?

Mark Carney voted to leave rates unchanged. He wasn’t defied.

Before the Fed raised rates in March, Fed members did a concerted media tour and shifted market expectations, which weren’t pricing in a hike. When they actually raised rates, it wasn’t a shock. In this case, Mark Carney and his colleagues might just do the talk instead of walking the walk, similar to Draghi’s show: the ECB knows how to keep the euro lower just by using words.

What do you think?