The international crude oil prices continued to post solid gains over the past two months. Price of WTI crude oil reached $57.87 a barrel after crude oil prices broke past the technical resistance barrier of 57.25 – 51.80 just last month.

The gains in oil prices came amid a mix of both fundamental and political factors. It was only in September that the hurricanes in the U.S. impacted oil inventories to an extent. However, despite the United States quickly recovering from the impact of the hurricanes, political developments in the Middle East quickly escalated. These factors helped oil prices to post strong gains as a result.

Saudi power struggle

The bullish momentum in oil prices quickly caught on after just a week ago, Saudi Crown Prince Mohammad bin Salman issued orders for arrest for wide ranging high ranking officials in the kingdom. Several princes and ministers were arrested on his orders as Saudi officials framed the move as a crackdown on corruption.

However, international observers viewed the move as a political consolidation by the crown prince who is on an ambitious plan to reshape the economy for Saudi Arabia. The kingdom also took a hit during the height of the oil supply glut. With oil prices declining sharply, the kingdom had to cut back on its freebies. This led to draining of its resources and its coffers.

The move by the crown prince, dubbed a purge was seen as an effort by the crown prince to strengthen his position. The political drama also pushed oil prices higher as a result.

Saudi – Iran tensions rise again

The tensions between Saudi Arabia and Iran came back into the forefront. Most recently, Lebanon was caught in the crosshairs as tensions quickly escalated. This came as the Lebanese Prime Minister Saad Hariri announced his resignation from Saudi Arabia.

It is a widely known fact that Saudi Arabia and Iran have been engaged in a long term proxy war. This time Lebanon was seen as the playground. Last week, Saudi Arabia and its allies in the Middle East issued warnings for its citizens to leave Lebanon. This has also formed an unlikely alliance between the United States, Saudi Arabia, and Israel.

Similar scenes continue to play out in the country of Yemen as well as both the Shia and the Sunni sides attempt to gain more influence in the region.

Saudi Arabia also accused the Iran backed Hezbollah of firing Iran-made missiles from Yemen.

While such power struggles are not new to the region, this has only helped oil prices to push higher.

OPEC Meeting due later this month

In the last week of November, the OPEC member nations including Russia will be holding their bi-annual meeting. The main topic will, of course, be the potential to extend the supply cuts. However, while the oil cartel continues to cut back on supply, this has also brought back the U.S. shale oil drillers back into the picture.

Although various leaders have mentioned that the outcome will be positive not all are excited. For example, analysts at Citigroup suggest that the OPEC meeting this month will be disappointing.

Despite the decision to extend the oil cuts and the markets already expecting this to extend into the end of next year, the higher oil prices no doubt will bring back more activity from the U.S. shale oil drillers.

Analysts say that there is also a potential for the OPEC members to put off the decision until January or February next year. This comes as the Russian energy minister Alexander Novak told reporters earlier in November that member nations might not have to necessarily decide on the supply cut extensions at this month’s meeting.

Will oil prices post a correction?

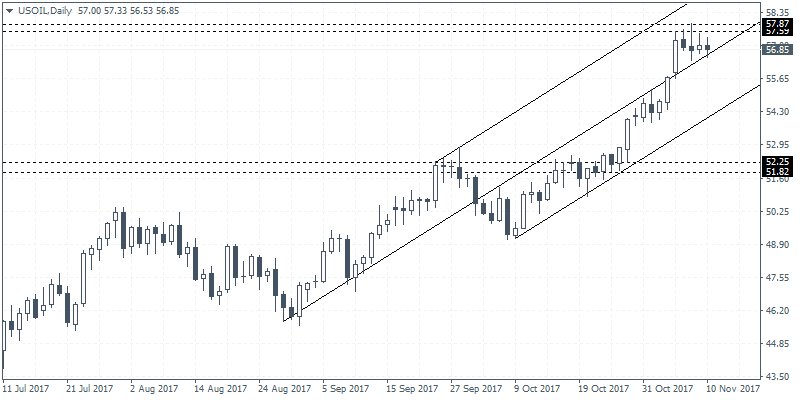

From a technical stand point, the strong rally in crude oil prices suggests that there is scope for a short term correction. With the technical resistance formed near 57.87 – 57.59, we expect to see oil prices correct towards 52.25 – 51.82 in the near term.

WTI Crude Oil Technical Chart

With the price level of 52.25 – 51.82 previously serving as resistance, the break out from this level saw little retest to establish support. The strong rally to 57.87 also came with little pullbacks. This would suggest that exhausting momentum near the current highs could send oil prices falling back to 52.25 – 51.82 in the near term.