In early 2017, President Trump made a comment that caught many by surprise. The ‘dollar was too strong’, he said. Consequently, this meant that the U.S government would no longer be in favor of the Clinton-era two-decade strong dollar policy. According to David Woo, Head of Global Rates and Foreign Exchange research at Bank of America, Trump administration would not want a strong dollar. A strong dollar does nothing for whatever Trump is trying to do, he added in an interview in early 2017. For many years, the U.S fundamental story has been bullish for the U.S dollar. However, the problem at the start of Trump’s era was that a strong dollar was no longer a likable option.

The remarks of the president also shocked the somewhat crowded trade – long wagers on the dollar. Before the election, the long wager trade was for the opinion that Trump’s policies would reflate the economy which would then mean interest rates and the greenback would rise. But that would then mean American exports would be more expensive for foreign buyers. It can be seen why Trump favored a weaker dollar.

How has the performance of the U.S.D been so far?

In 2017, the U.S dollar went through a somewhat rough patch after recording the worst performance in 14 years. However, according to the forecast of many analysts then, 2018 was to be a better year for the dollar.

The greenback which started in 2017 and strongly underpinned President Trump’s promises to cut taxes and spend $1 trillion on infrastructure. However, things did not turn out as expected as the U.S dollar fell by 10% by the end of 2017. The performance was opposite what most currency strategists had forecasted at the start of 2017.

In December 2017, there was a time when the USD rose by more than 2%. This spike came about after speculators bet that Congress would deliver legislation for sweeping tax cuts to individuals and corporations.

At the start of the year, 2018, the dollar still showed little resistance. According to a poll of 70 foreign exchange experts conducted by Reuters on Jan 2-4, the Euro and other major currencies will make further modest gains against the dollar by the end of the year.

According to Jeremy Stretch, Head of G10 FX strategy at CIBC Capital Markets, the dollar is going to remain on a downward trajectory through the course of 2018. Even if the Federal Reserve does deliver the widely expected three interest rates in 2018, it is not likely to reverse the dollar weakening trend, said Lee Hardan in January.

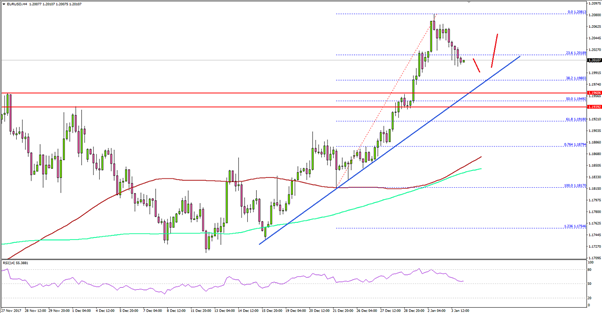

The USD compared with the EUR

Given how tough 2017 was, many currency forecasters agree that 2018 will be a better year for the U.S dollar. Currency speculators revised their net short dollar bets to their lowest since November 2017, according to data from the Commodities Futures Trading Commission for the last week of 2017.

On the other hand, the Euro which enjoyed its best run in 2017 since 2003 is set to weaken slightly in early half of 2018 before moving up to trade above $1.21. The Eurozone has been enjoying one of the best runs since the currency was launched. It is expected to grow at a robust pace in 2018 and 2019.

The EUR/USD pair was trading near its yearly low of 1.1908 which was reached on May 4th, 2018. This was after the Nonfarm Payroll report, with the greenback being felt strongly across the board.

The USD historical trends

According to Citi analysts, the USD has tended to appreciate in cycles of 5-6 years and after that depreciate for around 10 years at a time. The last peak began in 2011. This would then mean that the peak in the USD index experienced in early May 2018 might be the start of a new USD bear market. This is despite the fact that the Fed continues to raise rates. Citi analysts believe that a lower USD is more likely over the longer term.

The Citi analysts position seems to be supported by a group of economists among them former Fed Chair Janet Yellen. In an essay published in April 2018, the economists argue that 2017’s aggressive tax cuts are at the heart of the worsening budget situation that will see deficits surge in coming years. This study rebuts a study from Stanford University’s Hoover which blamed entitlement spending for the country’s worsening financial state.

According to the Yellen and team paper, the tax cut legislation reduced the corporate tax rate to 21% from 35% and decreasing taxes for millions of Americans. This was followed by Trump’s signing of the $1.3 trillion omnibus spending bill. According to the Congressional Budget Office, it expects these tax cuts to add $1.6 trillion to the country’s deficit over the next ten years.

Still, Fitch Ratings has said that even though the tax cuts and spending increases have added pressure on the government finances, the U.S has a higher ‘debt tolerance’ than many nations. This is because of the U.S dollar’s standing as the global reserve currency and also due to the deep and liquid market for the country’s Treasury.