- Quarterly Canadian GDP is expected to show moderate growth in the cold first quarter.

- The BOC’s upbeat statement raises expectations for more robust growth.

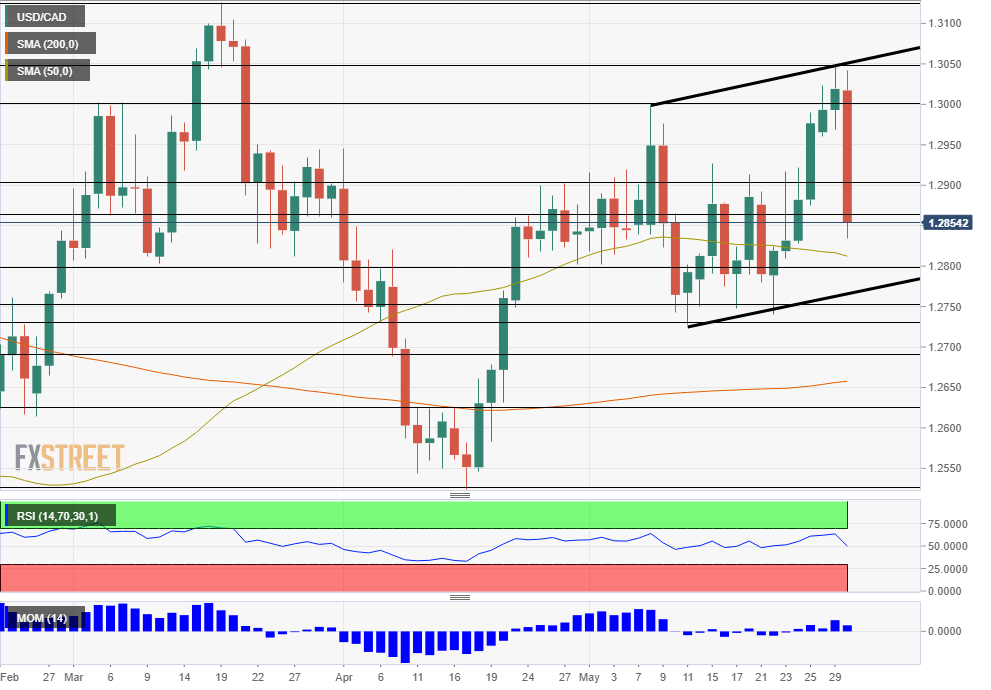

- The USD/CAD has traded in a broad channel ahead of the release.

Canada publishes its GDP report on Thursday, May 31st, at 12:30 GMT. The nation releases growth figures on a monthly basis but once every three months; it releases the quarterly figures which have a more significant impact on the Canadian Dollar. This publication concludes the first quarter of 2018.

2017 was a positive year of growth but the pattern was choppy: the first half saw faster growth than the second half. While oil prices are rising, fears about trade with the US have grown as NAFTA negotiations have not gone anywhere fast. The housing market has also experienced some turbulence with local attempts to curb spiraling prices and foreign buying. We will now get the first figure for 2018.

As with many other countries in the northern hemisphere, Canada suffered a cold winter than dampened growth. The Bank of Canada estimated an annualized increase of 1.3% during the period, significantly lower than 2.2% in the US according to the latest data.

However, economists’ expectations stand at 1.8% as the economic calendar demonstrates. Growth rates between 2% and 2.5% are considered the New Normal, or in one word: mediocre.

BOC boost

Expectations have risen quite a bit thanks to the fresh rate decision by the Bank of Canada. The BOC left interest rates unchanged but released a very hawkish statement. They omitted the reference to “caution” regarding interest rates and dropped the need for accommodative monetary policy. Governor Poloz and his colleagues also expressed satisfaction from wage growth.

And regarding GDP, they explicitly said that first quarter growth is stronger than estimated. The Ottawa-based institution specifically noted robust export growth and was also content with consumption which is set to continue rising throughout the year.

So, the BOC probably raised real expectations and the “whisper number” could be above 2%. This is important to note when trading the release. High expectations can lead to disappointments, allowing profit taking after the big upwards move in the Canadian Dollar. However, if the BOC says growth has been good, we can believe them. The question: how good does it get and what exactly is priced in?

USD/CAD positioning

The BOC not only raised expectations for a rate hike and a high growth rate but also boosted the Canadian Dollar.

The RSI no longer points to a bullish bias on the pair but a more neutral one. The 50-day and 200-day Simple Moving Averages are in play once again.

The pair is trading in a wide and moderate uptrend channel. While it stays within the boundaries, the trend remains to the upside.

Significant levels to watch from top to bottom: 1.3050 (the recent peak and the uptrend support level), 1.3000 (critical round number), 1.2900 (round number and resistance on the way up), 1.2870 (another stepping stone on the way up), 1.2800 (round number and support a few weeks ago), 1.2750 and 1.2730 (recent lows).

More: USD/CAD Forecast: BOC puts rosy glasses and sent the pair plunging