Blockchain technology is currently being hailed as, well, many things. In any given day you might see it called a disruptor or the future of financial transactions or the answer to data storage and digital identity issues or the technology that will finally put an end to DDoS attacks. New technologies are never a stranger … “The end of DDoS? Future promises and current problems with blockchain technology”

Month: May 2018

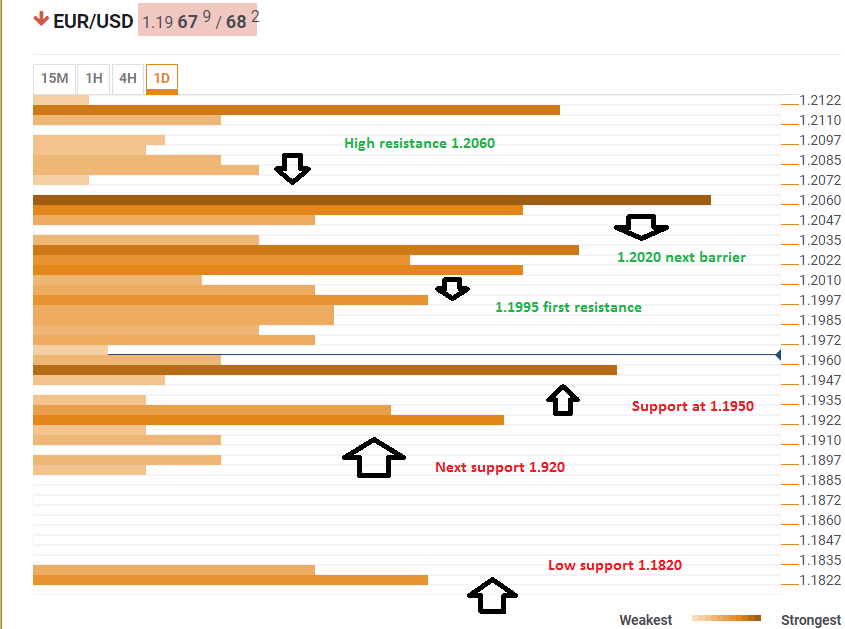

More resistance than support for the EUR/USD ahead of the NFP

The Technical Confluences Indicator shows that the battle lines are well-defined toward the all-important release of the US Non-Farm Payrolls. A congestion of support lines awaits around $1.1950 with the one-day High, the Bolinger Band one-day Lower, and the Pivot Point one-day Support 1. Further support is at $1.1920 which sees the confluence of the Pivot Point one-day S2 and … “More resistance than support for the EUR/USD ahead of the NFP”

Canadian Dollar Mixed amid Clashing Fundamentals

The Canadian dollar was mixed today, rising against some currencies and falling versus others. The possible reason for that were clashing fundamentals, which did not provide a clear direction to the loonie. Statistics Canada reported that the trade balance deficit widened from C$2.9 billion in February to C$4.1 billion in March. That is instead of shrinking to C$2.3 billion as economists had predicted. Looking deeper into the report, the situation did … “Canadian Dollar Mixed amid Clashing Fundamentals”

US Dollar Stays Volatile as Traders Speculate About Fed Policy

The US dollar remained extremely volatile following yesterday’s Federal Reserve meeting. The currency was soft at start of today’s session but attempted to rally later. As a result, the greenback was mixed today. The Fed kept the target range for the federal funds rate at 1.5% to 1.75% as was expected by basically everyone. Some analysts pointed at the word “symmetric” that described inflation goal, interpreting them as a sign that the Fed can tolerate overshooting … “US Dollar Stays Volatile as Traders Speculate About Fed Policy”

Sterling Pound Falls on Weak UK Services PMI Data

The Sterling pound today declined slightly against the US dollar following the release of the weak Markit/CIPS UK Services PMI data in the early European session. The pound was minimally affected in the early American session after several releases from the US docket such as the positive jobless claims data. The GBP/USD currency traded mostly in a range today as bulls battled the bears for control with neither side emerging as the winner. The cable was stuck … “Sterling Pound Falls on Weak UK Services PMI Data”

Euro Posts Slight Decline on Disappointing Eurozone CPI Data

The euro today registered a slight decline against the US dollar following the release of the Eurozone Consumer Price Index data in the early European session. The EUR/USD currency pair began today’s session in positive territory and had rallied to highs above 1.2000 before trimming some of its gains after the CPI release. The EUR/USD currency pair today declined from a high of 1.2010 to a low of 1.1965, but was still higher for the day having … “Euro Posts Slight Decline on Disappointing Eurozone CPI Data”

Australian Dollar Benefits from Positive Macroeconomic Data

The Australian dollar gained on its major rivals today thanks to a bunch of positive macroeconomic reports released over the current trading session. The session kicked off with not-so-good data as the seasonally adjusted Australian Industry Group Australian Performance of Services Index fell to 55.2 in April from 56.9 in March. Other reports were far better, though. The trade balance surplus widened to A$1.53 billion in March from A$1.35 billion in February. … “Australian Dollar Benefits from Positive Macroeconomic Data”

Pound Loses Gains Caused by Surprisingly Good Construction PMI

The Great Britain pound was lifted intraday by a surprisingly good report about the construction sector. By now, though, the currency has trimmed its gains, losing them outright against some rivals, like the US dollar and the Japanese yen. The seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managersâ Index climbed to 52.5 in April from the March’s 20-month low of 47.0. The actual value was not only above the neutral 50.0 … “Pound Loses Gains Caused by Surprisingly Good Construction PMI”

EUR/USD Drops on Renewed US Dollar Demand Ahead of FOMC Decision

The euro today dropped to new lows against the US dollar following a resurgent demand for the greenback ahead of the FOMC interest rate decision. The EUR/USD currency pair broke down from its initial sideways trading range in the early American session as the greenback rallied higher. The EUR/USD currency pair lost over 75 points to decline from a high of 1.2032 to a low of 1.1951 breaching the crucial 1.2000 psychological level. The currency pair was … “EUR/USD Drops on Renewed US Dollar Demand Ahead of FOMC Decision”

Services sector survey could determine the dollar correction

The ISM Non-Manufacturing PMI provides insights about the broad services sector and also serves as a hint towards the NFP. The indicator may test the question if the US Dollar has reached overbought conditions. The purchasing managers’ index for the services sector is published by ISM on Thursday, May 3rd, at 14:00 GMT. The services … “Services sector survey could determine the dollar correction”