The Canadian dollar rallied today, reversing its earlier losses. The currency got a boost from Canada’s solid economic growth. Statistics Canada reported that gross domestic product rose 0.5% in May after increasing 0.1% in April. Analysts had predicted a smaller increase by 0.3%. In June, both the Industrial Product Price Index and the Raw Materials Price Index also rose 0.5%, though in this case the rate of growth significantly … “Canadian Dollar Reverses Losses After GDP Beats Expectations”

Month: July 2018

MiFID 2.1 – How Will Brexit Change the Rules?

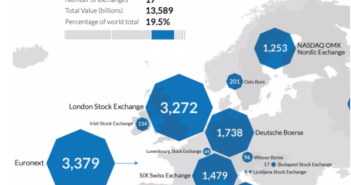

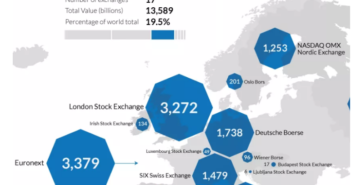

Brexit, the official withdrawal of the United Kingdom from the European Union, kicked off on March 29, 2017, with two years set to “B-Day” on March 29, 2019. Over 50% of the British public voted to leave the EU in a referendum with a turnout exceeding 72%. But could this move affect the financial markets … “MiFID 2.1 – How Will Brexit Change the Rules?”

MiFID 2.1 – How Will Brexit Change the Rules?

Brexit, the official withdrawal of the United Kingdom from the European Union, kicked off on March 29, 2017, with two years set to “B-Day” on March 29, 2019. Over 50% of the British public voted to leave the EU in a referendum with a turnout exceeding 72%. But could this move affect the financial markets … “MiFID 2.1 – How Will Brexit Change the Rules?”

Turkish Lira Declines After Central Bank Upgrades Inflation Forecast

The Turkish lira fell today after Turkey’s central bank revised its inflation forecast up. The currency declined even as the bank signaled about possibility of an interest rate hike. The Central Bank of the Republic of Turkey released the Summary of the Monetary Policy Committee Meeting for the last week’s policy meeting. After the gathering, the bank surprised markets, refraining from increasing borrowing costs to tame accelerating inflation. In the today’s notes, the central bank revealed … “Turkish Lira Declines After Central Bank Upgrades Inflation Forecast”

Euro Rallies Higher on Mixed Eurozone Data and Weak US PCE Data

The euro today rallied higher against the US dollar from the late Asian session into the early European session following positive releases from across the Eurozone. Releases from the US docket in the early American session triggered a slight pullback in the EUR/USD currency pair. The EUR/USD currency pair today rallied from an initial low … “Euro Rallies Higher on Mixed Eurozone Data and Weak US PCE Data”

Chinese Yuan Depreciates As Economy Weakens, Manipulation Concerns Linger

The Chinese yuan weakened against the US dollar and a basket of currencies on Tuesday. Despite some modest gains in July, the currency is still hovering around a 13-month low, leaving many traders and world leaders wondering if Beijing is manipulating the yuan. It has been several months since the US government applied hefty tariffs … “Chinese Yuan Depreciates As Economy Weakens, Manipulation Concerns Linger”

NZD Falls After Macroeconomic Releases in New Zealand & China

The New Zealand dollar fell versus its most-traded peers, with the exception of the extremely weak Japanese yen, after underwhelming macroeconomic releases in New Zealand as well as in New Zealand’s major trading partner — China. Statistics New Zealand reported that building consents fell 7.6% in June following the 6.9% rise in May. ANZ Business Confidence dropped from -39.0 in June to -44.9 in July. The report said: Headline business confidence … “NZD Falls After Macroeconomic Releases in New Zealand & China”

Japanese Yen Drops After Uneventful BoJ Meeting

The Japanese yen fell against all of its major rivals today. While domestic macroeconomic data was certainly unhelpful, the biggest reason for the drop was the uneventful Bank of Japan policy meeting. The BoJ left its monetary policy largely unchanged, keeping the main interest rate at -0.1%. The central bank introduced forward guidance for policy rates, saying: The Bank intends to maintain the current extremely low levels of short- and long-term interest … “Japanese Yen Drops After Uneventful BoJ Meeting”

Canadian Dollar Gains on âAbsolutely Amazingâ NAFTA Talks, Higher Oil Prices

The Canadian dollar is rallying to start the trading week, benefiting from reported progress in North American Free Trade Agreement (NAFTA) negotiations and higher energy prices. The loonie may tumble later in the week as the US central bank completes its Federal Open Market Committee (FOMC) policy meeting that could signal a September rate hike. Speaking in an interview with Fox News, White House Council of Economic Advisers Chairman … “Canadian Dollar Gains on âAbsolutely Amazingâ NAFTA Talks, Higher Oil Prices”

EUR/USD: Could See 1.1750 This Week Before Breaking Out Of Range In August – SocGen

EUR/USD is stuck in a range for a long time. What’s next? A breakout may be close. Here is their view, courtesy of eFXdata: Societe Generale Cross Asset Strategy Research discusses EUR/USD outlook and notes that prices need to close above 1.1690 by the end of play tomorrow to avoid a fourth consecutive monthly fall – the longest … “EUR/USD: Could See 1.1750 This Week Before Breaking Out Of Range In August – SocGen”