The EUR/USD is trading at new highs for September, around 1.1670. ECB President Mario Draghi is the primary driver of the common currency to higher ground. In the previous five press conferences, Draghi pushed the Euro lower.

How is Draghi different this time?

1) Super Mario

The ECB left the inflation forecasts unchanged for 2018, 2019, and 2020. This is surprising given the small downgrade in GDP and the recent disappointment in August’s inflation numbers.

Draghi also called risks as balanced. He also said there was a discussion about changing the assessment to “downside risks.”

Another positive is that the central banker says that there are upside risks from not-so-neutral fiscal policies. Also, an improvement in the labor market and also in wages.

The ECB decision comes on the eve of QE tapering. The Frankfurt-based institution is about to cut its bond-buying program from €30 to €15 billion in October and plans to stop buying bonds in 2019.

While Draghi did talk about protectionism, referring to Trump’s tariffs, the language has not materially changed from previous statements.

2) Turkish mega-rate hike

The Central Bank of the Republic of Turkey defied the President and hiked rated by 625 basis points to a whopping 24%. This topped market expectations for 21% or 22% and came against a speech by the President just two hours before the decision. It is still to be seen if the CBRT will be bold and remain independent.

The euro-zone is exposed to Turkey via close trade ties. Also, the ECB was concerned about three major euro-zone banks when the crisis erupted. The sharp rate hike in Ankara also helped the common currency, pushing the EUR/USD a bit higher.

3) Weak US inflation

After several months of gradual increases, the US Consumer Price Index disappointed with 2.2% Core CPI YoY. Other measures also came out below expectations. While the data will not stop the Federal Reserve from raising rates in two weeks time, it may bring the Fed closer to a pause. The interest rate is becoming neutral, close to the level of inflation. Under these circumstances, the Fed is unlikely to tighten much further.

FXStreet Expert Joseph Trevisani says:

The unexpected drop in US CPI in August undermines the supposed consumer price effect from tariffs

The US Dollar tumbled down across the board on the news, driving the EUR/USD higher as well.

EUR/USD levels

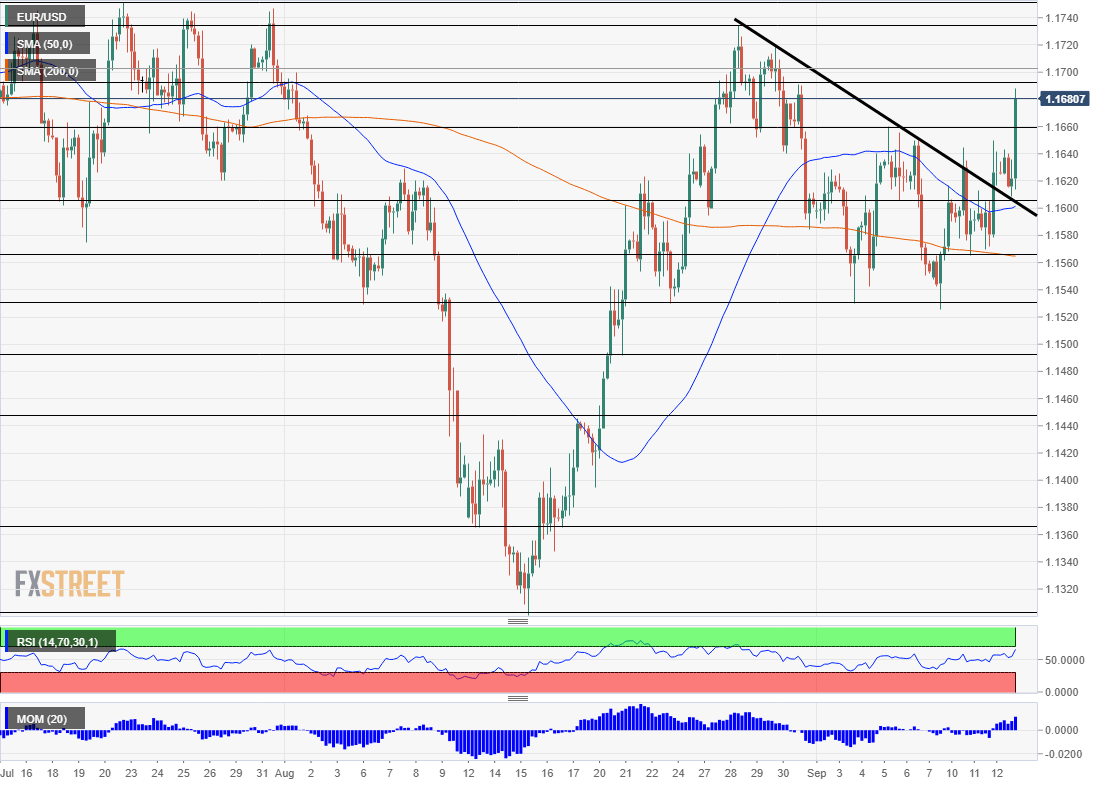

1.1695 was the peak back in late August and is the first line to watch. The August high of 1.1735 is the next level on the charts. Close by; we see the quadruple top of 1.1750 that capped the pair in July. Even higher, 1.1850 was the peak the EUR/USD reached on June 14th, before Draghi sent it tumbling down.

The previous September high of 1.1660 is now a line of support. Further down, 1.1600 is a round number and served as a magnet. 1.1565 was the trough earlier int he week. 1.1530 is a triple bottom.

Get the 5 most predictable currency pairs