- The BTC/USD had an exciting week, recovering nicely and making a nice U-turn.

- Interest from Morgan Stanley pushed prices higher and so did Mike Novogratz’s comments.

- The technical picture is mixed for the digital coin.

The price of Bitcoin made an impressive recovery, advancing from enjoying a bounce of over $400 and topping $6,500. Morgan Stanley is reportedly venturing into Bitcoin trading, responding to demand from clients. The report from Bloomberg on the topic may have been the trigger, but other reports suggest significant short-covering after a sharp sell-off beforehand.

Citigroup, another financial behemoth, is also showing interest in digital coins. Goldman Sachs vehemently denied new that it is abandoning its plans for a crypto trading desk. An ex-Goldman Sachs banker and ex-hedge fund manager, Mike Novogratz, said that Bitcoin has bottomed out. He is heavily involved in the blockchain world as a crypto fund manager.

The focus now turns to the next deadline for approving a Bitcoin Exchange Traded Fund (ETF). The Securities and Exchange Commission (SEC) has set September 21st as the new deadline for approving or disapproving five Bitcoin ETF’s. These are Direxion Daily Bitcoin Bear 1X Shares, Direxion Daily Bitcoin 1.25X Bull Shares, Direxion Daily Bitcoin 1.5X Bull Shares, Direxion Daily Bitcoin 2X Bull Shares, and Direxion Daily Bitcoin 2X Bear Shares.

The deadline for the Direxion requests precedes a September 30th deadline for other significant ETF contenders. ETF’s are critical for Bitcoin as they provide a gateway for mainstream traders and investors to enter the world of digital currencies. Speculation about ETF’s has been a crucial mover for crypto prices.

To understand more about ETF’s see: Bitcoin ETF explained: 9 questions and answers about the critical crypto catalyst

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

What’s next for Bitcoin?

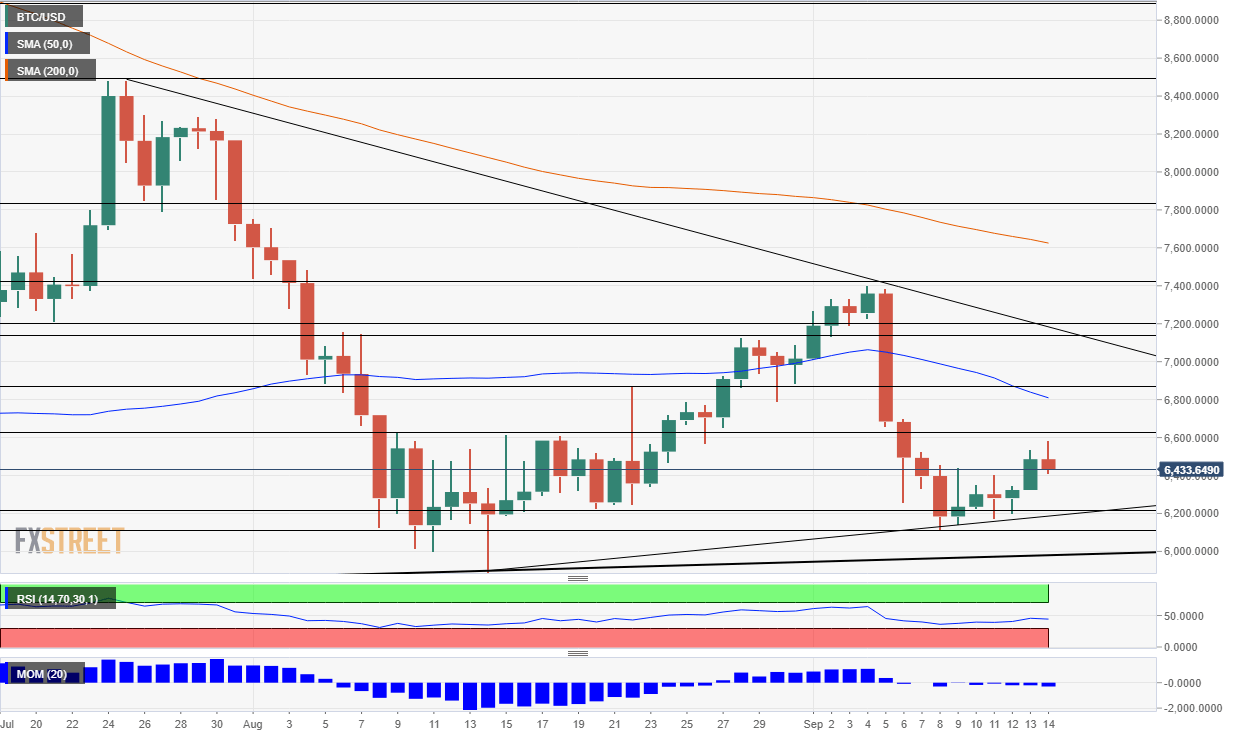

BTC/USD Technical Analysis – A few bullish signs

The recent downturn did not reach the lows below $6,000, and this is a bullish sign. However, other indicators are more nuanced. The BTC/USD is still trading below the 50 and 200 Simple Moving Averages. Momentum and the Relative Strength Index are not going anywhere fast.

$6,630 capped the pair in August and looms over prices at the time of writing. $6,870 was a swing high in mid-August and then a temporary low later in the month. $7,145 capped the pair in early August and served as support in early September. Close by, $7,200 cushioned the BTC/USD price just before the most recent drop. $7,400 was the peak early in September.

Looking down, $6,200 was a support line in August and also helped the pair stabilize this week. It is closely followed by $6,110 which was the low point of the downturn. Below the round level of $6,000, we find $5,891 as the August low before the 2018 trough of $5,770.

The Forecast Poll of experts provides interesting insights.

More: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: last breath or rebirth for Ethereum?

Get the 5 most predictable currency pairs