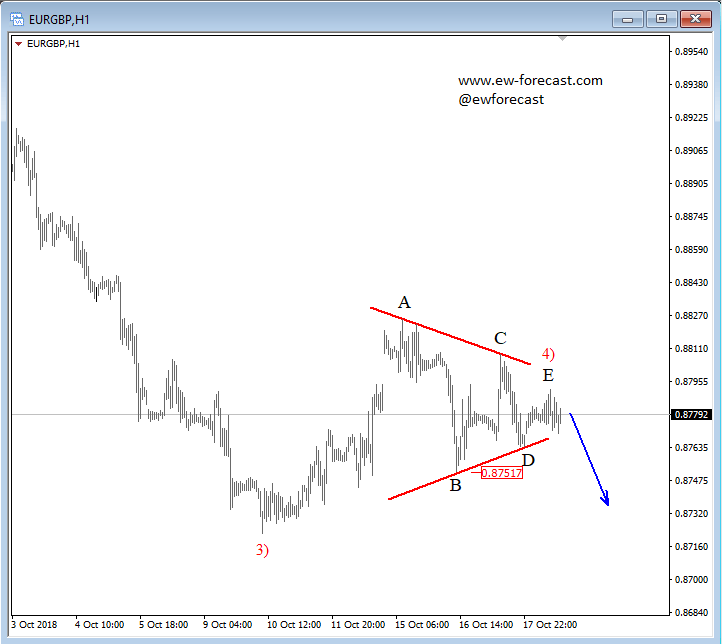

EURGBP can be trading at the end of a big triangle correction in wave 4); pair which can look for more weakness once the lower triangle line and the 0.8751 level gets breached. Also, a triangle correction is a continuation pattern, that unfolds prior to the final leg, and can suggest more weakness once recognized. Triangles usually unfold in waves 4 and B and never in wave 2. That said, a drop in impulsive fashion will suggest a continuation towards 0.8700 area.

EURGBP, 1h

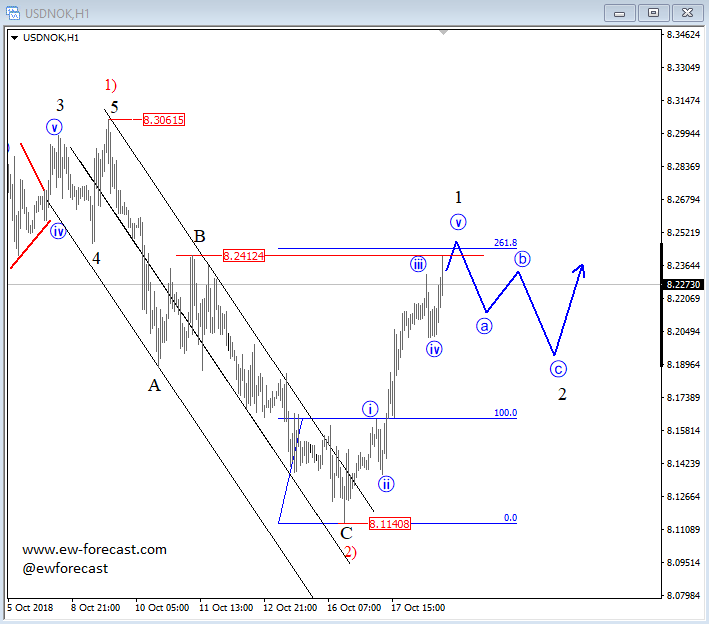

USDNOK made an impulsive bounce from 8.114 area, so seems like bulls are still in play after a deep three-wave A-B-C decline from 8.306 high. That said, we should be aware of more upside after current five-wave rally, but before pair may continue higher we may see a small three-wave corrective pullback that can test 8.20-8.15 support area. Even if price goes more complex we remain bullish as long as pair trades above 8.11 region.

USDNOK, 1h

Get the 5 most predictable currency pairs

EURGBP Looks Bearish, while USDNOK Aims for Higher Prices – Elliott wave Analysis